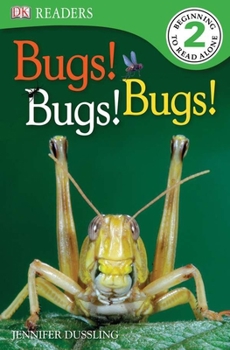

DK Readers: Bugs! Bugs! Bugs! (Level 2: Beginning to Read Alone)

(Part of the DK Eyewitness Readers Series and DK Readers Level 2 Series)

Select Format

Select Condition

Book Overview

You Might Also Enjoy

Customer Reviews

Rated 5 starsfun book for bug lovers

I bought this book for my son for his 6th birthday. He loves it. The photographs are great and it is very informative. Great for young science lovers.

0Report

Rated 4 starsI'm a big fan of the DK readers.

They're simply written non-fiction books. Most non-fiction books are written for older kids, or for younger kids only as read-alouds. A series of *factual* books that early readers can read to themselves? Brilliant. Not every kid wants fairies and talking dinosaurs all the time. Sometimes, they really just want plain facts. I really like these books. I do have one minor problem with them, and that is that the text is really...

0Report

Rated 5 starsVERY Fascinating book!

This is just a great book! Moms and dads will be just as interested in learning about these bugs as the young ones are. Hearing the word, "cool" when learning about science, etc., is quite nice and this book does that job very well. It's pretty neat seeing the praying mantis eat a fly, the dragonfly that was rotted into a rock, and all about the thorn bugs. Great reading for young ones, not too difficult but the little...

0Report

Rated 4 starsJust Plain Buggy!

My sons enjoyed this book tremendously. I heard the word "cool" come out of thier mouths more than once. The pictures were very detailed. It was easy for my first grader to read.

0Report