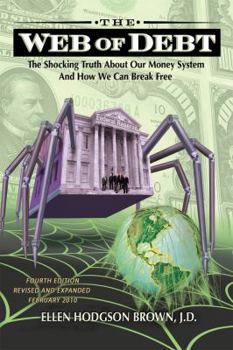

Web of Debt: The Shocking Truth about Our Money System and How We Can Break Free

Select Format

Select Condition

Book Overview

This book exposes important, often obscured truths about our money system and our economic past and future. Our money is not what we have been led to believe. The creation of money has been... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0979560888

ISBN13:9780979560880

Release Date:March 2010

Publisher:Third Millennium Press

Length:544 Pages

Weight:1.70 lbs.

Dimensions:1.1" x 6.0" x 9.0"

Customer Reviews

4 ratings

Astonishing, Enfuriating, Terrifying.

Published by Thriftbooks.com User , 16 years ago

This book is just fantastic. It's worth reading for the history of the monetary system alone. No matter what the lone negative reviewer so far (T. Anderson) here may say, any flaws are mere quibbles. I have multiple degrees in the humanities, and have taken courses in economics, and have read all the big guns in the canon (Smith, Riccardo, Malthus, Marx, Marshall, Keynes, Freidman, etc, etc.) but have never read anything quite like this before. All the great economists are in the end finally propagandists for their particular worldviews. We are rarely reminded that in essential ways their craft is rooted in that dirty realm: metaphysics. The economists would like us all to believe that what they do is science, that it is a solidly rooted empirical craft. But the fact is that some of the most fundamental aspects of the discipline are rooted in that oftentimes most irrational, insubstantial and fleeting of things: human desire. Money itself is the sublime exemplar of this fact. This odd measure of value. It is so ubiquitous in our culture, so fundamental to how we all live, yet we rarely sit and contemplate what it really "is." Where it comes from, what it does, and who (in the final analysis) really controls it. Most of us spend most of our waking hours chasing it, without really understanding what it really is we are doing. Ellen Brown has given us all an opportunity to change that. Again, no matter that there are some few factual and perhaps conceptual flaws here. There's still a gluttonous orgy of food for thought in these pages. Starting with a brilliant expose of the origin of the banking system, and it's logic, she flays the monetary system and lays its anatomy out for examination. She gets you to think about what the banks are really doing when they loan.. what exactly is happening when they extend us those oh so seductive lines of revolving credit; what the nature of your mortgage really is. She leads us from the Renaissance goldmerchants' creation of the nascent capitalist banking system, through the 18th & 19th century struggles over control of the money supply, all the way through to an analysis of the current mortgage crisis. She warns us what may yet be in store for us if and when Freddie Mac finally defaults on its 700 billion in bond obligations. MSNBC, the Wall Street Journal, Kiplinger Report and Economist will never explain any of this to you. I think we all can intuit why that is. You owe yourself this education. This information ought to be part of our daily political discourse, and a part of every high school education. Again, you gotta wonder why it is not. Final Admonition: Acquire & Read this Book. You will not regret it.

Follow the Yellow Brick Road... to comprehend a financial system on the brink of collapse

Published by Thriftbooks.com User , 17 years ago

I have been researching this topic myself for four or five years now and am familiar with almost every other book in this genre, and I can unequivocally say that this is now the definitive work on the world's financial and banking system, the history of money and power in Western civilization, and the dire prognosis for our economy and our personal freedoms, in general, as a result. It is vastly superior to "The Creature from Jekyll Island", to compare it to one other fine book on the subject that is now outdated, both in terms of its complete historical coverage, as well as a completely up to date perspective on recent financial history and a deeply insightful analysis of our current debt crisis, why it was let out of control, and who would benefit from its ultimate unwinding. Quite frankly, looking back four to five years from now, this could be the most profound non-fiction work of our times. Robert Hemphill, Credit Manager for the Federal Reserve Bank in Atlanta, when speaking on the same topic as this book, stated, "It is the most important subject intelligent persons can investigate and reflect upon." I couldn't agree more, and even encourage many unintelligent persons to give it a go. The mechanics of money and finance have a profound affect on every person's life and well being, and is inextricably linked to the fabric of our society and our freedom. Yet it is almost completely ignored and poorly understood by the common man. As Henry Ford said, "It is well that the people of this nation do not understand our banking and monetary system, for if they did, I believe there would be revolution before tomorrow morning." It's time we all started to understand what's been going on and how it will affect our immediate future. Ellen Hodgson Brown does a remarkable job at making this subject both easily understandable and richly entertaining while not pulling any of the sordid details or facts. It's impressive in its clarity, fascinating to read, and educational for anyone who might already think they fully understand the system. Unknown to most, The Wizard of Oz was written as a parable for our monetary system. Ms. Brown takes us down that yellow brick road and shows us that the reason L. Frank Baum's timeless story resonates with us so deeply is that our own world works much the same way as the Land of Oz, with a parallel cast of characters. It lies within our power, and in this book, to find our own ruby/silver slippers, thus avoiding the crisis to find our way back home to the real utopia.

Simply the Best, Better Than All the Rest

Published by Thriftbooks.com User , 17 years ago

The lyrics from the Tina Turner song 'The Best' come to mind. The author is an attorney. If she pled her plaintiff's case in court for an alternate money system as presented in this book, and you were on the jury, decide which way you would vote. Her client is the debt oppressed people of society, and also most governments around the world. The defendant is the privately owned central banks of the world. Read it, and cast your vote.

The Money Trap Fully Explained-With an Exit Stategy

Published by Thriftbooks.com User , 17 years ago

This is simply the most thorough, researched, and up to date book of its kind. I would call it essential to have, as the national and global economic situation is entering right now into the dramatic and tumultuous throes of the end of the 100 year or more Ponzi scheme that IS our national economy. There have been terrific books by Griffin and Mullins and quite a few others describing the origins of the monetary system that has brought us to this point of collapse and ruin; but they are 20 to 30 years old, and do not include and explain the latest machinations of the Debt/Money machine, such as derivitives, hedge funds, naked short selling, plunge protection teams, the petro dollar, the housing bubble and more. And all is explained, despite the book's historical breadth and up to date detail, in a story line narrative fashion that is personable and enjoyable, with a great sense of discovery. The best part is the optimistic presentation of what a sane and sensible money system might look like, that is free of deception and theft from hidden corporate masters. And the solution is not a simple reversion to a sort of fundamentalist gold approach.... The subject of gold is actually explored in all of its history of past abuse and control by the same sort of masters we now have, as well as the current pitfalls we would face. Solutions are based, however, upon the ideas and practices of some of America's founders, and on workable examples based upon what a community and nation' real wealth consists of. Can be read as a narrative, or you can jump in on any chapter and clarify a multitude of mysteries about just what levers are being pulled by the guys behind the curtain. I think the author goes in the right direction for a way out, but the book begs for a sequel dealing with the detailed design of such a plan, so it, too, does not become a trap a century later.