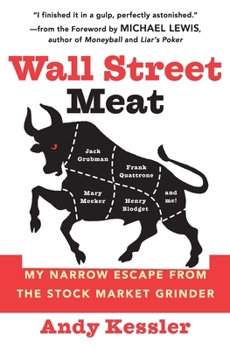

Wall Street Meat: My Narrow Escape from the Stock Market Grinder

Select Format

Select Condition

Book Overview

Wall Street is a funny business. All you have is your reputation. Taint it and someone else will fill your shoes. Longevity comes from maintaining that reputation. Ask Jack Grubman, the All-Star telecom analyst from Salomon Smith Barney; uber-banker Frank Quattrone at CS First Boston; Morgan Stanley's Mary Queen of the Net Meeker; or Merrill Lynch's Henry Blodget. Well, they probably won't tell you anything. But have I got some great stories...

Format:Paperback

Language:English

ISBN:0060592141

ISBN13:9780060592141

Release Date:January 2004

Publisher:Harper Business

Length:272 Pages

Weight:0.50 lbs.

Dimensions:0.7" x 5.3" x 8.0"

Related Subjects

Business Business & Investing Economics Finance Investing Professionals & AcademicsCustomer Reviews

4 ratings

Very interesting! A real pager turner

Published by Thriftbooks.com User , 19 years ago

The author, an ex-analyst of Morgan Stanley, talked of his personal encounters with some of the fallen angels of Wall Street (Mary Meeker is still there), the change in the role of analysts from research/brokerage support to investment banking/IPO tool that effectively broke the firewall/Long Wall between the two functions within the same company at investors' expense, and the interference of regulatory bodies that did more harm than good. To me, this is the second most interesting book of its kind, after Fiasco and better than Liar's Poker. It wont help your trading or investment, if you already know the uselessness (or how intoxicating in the author's term) of "recommendations" of those analysts who are paid in proportion to the qty and quality of suckers. The many bits and pieces are so interesting. If you wanna read for fun, this must be it. p.s. In case the term "Morgan Stanley" still means something to you, listen to Barton Biggs only, and neglect all else, especially Bryon Wien and Mary Meeker, in the author's opinion.

Stock Buffs guide to Real World Wall Street

Published by Thriftbooks.com User , 20 years ago

This is an excellent book to lift the curtain and see what really goes on working as an analyst on the street. This book is short, 200 pages,in big print, and makes a point of not taking itself too seriously as it describes a humorous, hard-working and deceptive Wall Street.Kessler was an engineer plucked from obscurity to become a stock analyst. With simple but great advice from his boss, Kessler flies by the seat of his pants learning the business from 1985 to the mid 90s. But what makes this book perfect is while he describes life on Wall Street and the many conflicts of interest as he learns the business, his Wall Street years were spent working along side many famous analyst who moved the market in the late 90s to the biggest stock market rally in history. Jack Grubman is the most prominent and is described as a good friend, fun-loving guy of incredible talent who later in life controlled the telecom market possibly with questionable tactics. Later he works with Frank Quattrone, known as the banker for the Internet. As an analyst, Quattrone and Kessler were many times on opposite sides of client debates. Kessler humorously describes their battles and debates while giving credit to Frank's unique talents and giving hints of how he might have helped in his downfall. Mary Meeker and Henry Blodgett are also mentioned from a perspective few investors would see from just reading about them in magazines or newspapers.I can't over-emphasize how much fun this book is. Many times authors try to tell you everything they know. Kessler, possibly from experience writing concise research reports, does a great job of saying a lot without using many words wasting your time. While this book will be good for anyone wanting to learn of the conflicts reseach analysts must face, it is a must read for novice or hobby stockpickers. If nothing else but to show you the system you are working against. I strongly recommend this book for all readers with interest in finance or the stock market.

LIARS' POKER meets the Tech Bubble

Published by Thriftbooks.com User , 20 years ago

This book is to the nineties what Michael Lewis's Liars' Poker was to the eighties-a whirling, candid look at Wall Street. I agree with Lewis's blurb: I gulped this book, too. He and Kessler both have a great comic sense. Both came to the financial world in a roundabout way. (Lewis was an art history major who became a bond salesman; Kessler was a Bell labs researcher who became a research analyst.) But there are differences, too, and they go beyond the simple fact that Lewis wrote about the character of Salomon Brothers and the mortgage-backed security business, whereas Kessler's story more broadly concerns the technology bubble of the late nineties, and Wall Street's part in it. Kessler is more sharp-edged and critical, yet idealistic, too, ending with a few pages of ideas on what caused the tech bubble and what might be done differently to prevent this sort of thing from happening again. Kessler writes from the vantage point of more than fifteen years in the securities business, and you sense he really cares about many of the people he works with. (Even if he frequently shows it by verbally skewering them.) Lewis's time on Wall Street was much shorter, and his tone is more one of bemused detachment. Kessler is very anecdotal, even more than Lewis, one- and two-pagers, but the chronology is solid and the whole thing works perfectly. The two books are close cousins, lots of hilarious stories and witty detail, and a sprinkling of memorable supporting characters, including a vivid yet balanced portrayal of fallen superstar Jack Grubman, through the years, by Kessler.

Behind the scenes of the latest scandal...Smashing!

Published by Thriftbooks.com User , 21 years ago

I rarely rate a book with 5 stars but this book richly deserves it for in succinct breadth and witty storytelling. In his wild expose, WALL STREET MEAT, Andy Kessler gives the reader a behind-the-scenes view of the antics of some of Wall Street's giants. The subtitle tells it all: Grubman, Quattrone, Meeker and Blodgett and Andy Kessler's relationships and experiences with each. To those even somewhat familiar with the SEC action of April 28, 2003, these names will stand out. MEAT tells us more, much more.Andy Kessler began his career as an electrical engineer designing microchips at Bell Labs. By some strange quirk of fate (or brainless move by a headhunter), he was thrown into the world of a Wall Street analyst. Kessler has seen more than most; his Wall Street career began before the infamous "Black Monday" crash (October 19, 1987) and spanned into the beginning of the Internet Bubble. During that time, Kessler met and worked with the individuals now being targeted for prosecution for their "exuberant" activities. Kessler went at it elbow-to-elbow with Jack Grubman while at PaineWebber (Grubman eventually moved on to Salomon Smith Barney); with Frank Quattrone (and Mary Meeker...truly a bit player here) while at Morgan Stanley (Quattrone eventually moved to Deutsche Bank and then to CSFB); and became well acquainted with Henry Blodgett AFTER Kessler turned in his analyst hat for that of a venture capitalist.Kessler goes to great lengths to inform the reader of the trials and tribulations of the Wall Street analyst in the 80's and most of the 90's. The difficulties and reticence he would feel each time he would put a "Buy" or "Sell" recommendation on a company are richly described as gnashing of teeth and firestorms. In this age, an analyst had to defend each recommendation as the Street's skepticism "appeared" to demand it. Conversely, as the Internet phenomenon hit the scenes, the code of the analyst changed from one of cautious recommendation to one of mindless, obtuse "dartthrowing." Although he provides us with many gems, Kessler recounts one poignant conversation with Blogett wherin Blodgett posits: "You've got to understand. If I stop recommending a stock, and the shares keep going up, there is hell to pay. Brokers call you up and yell at you for missing more of the upside. Bankers yell at you for messing up their relationships. There is just too much risk in not recommending these stocks." A perfect example of the mindset and excesses bringing Wall Street to its knees. In another conversation, now considered germane and somewhat paradoxical (given the chronology of events), Kessler recounts Quattrone's tutelage of the invisible "Chinese Wall." This "Wall" is a conceptual separation of research and investment banking designed to prevent insider information passing from bankers to analysts. Ironically, the breaching of this "Wall" was one of the acts eventually bringing Quattrone down.Kessler uses MEAT as part biography, part expose, and p