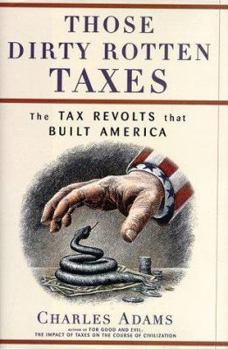

Those Dirty Rotten Taxes: The Tax Revolts That Built America

Select Format

Select Condition

Book Overview

From the Boston Tea Party to the Whiskey Rebellion to the Fries Rebellion, the late eighteenth century in America was full of armed violence in response to hated taxes. Yet, as Charles Adams recounts... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0684843943

ISBN13:9780684843940

Release Date:March 1998

Publisher:Free Press

Length:242 Pages

Weight:1.17 lbs.

Dimensions:0.9" x 6.4" x 9.6"

Customer Reviews

5 ratings

Hard Hitting History

Published by Thriftbooks.com User , 16 years ago

Those Dirty Rotten Taxes is, as the title implies, polemical in nature. Adams has strong views and does not shy from expressing them. Adams claims that excessive taxation was central to American history. There is much truth to this claim. The American War of Independence was driven largely by taxation, but not merely the absolute level. Taxes had been higher in colonial America, the colonists objected to arbitrary taxation without representation, not just the absolute level of taxation. That being said, Adams is still on to something important. Unjust taxation does serve to motivate political action. Tax revolts became less common and more tame with the passage of time precisely because many Americans have come to accept and even embrace our current tax system. That is, many Americans need to be shaken out of their complacency and delusions. The hard hitting prose of Those Dirty Rotten Taxes should be effective in its capacity to motivate the complacent. Delusional leftists are harder to deal with, as they tend to be dogmatic, if not intellectually dishonest. Be that as it may, Those Dirty Rotten Taxes is great as a polemical history of American taxation.

America was founded on a revulsion against taxation!

Published by Thriftbooks.com User , 16 years ago

~Those Dirty Rotten Taxes: The Tax Revolts that Built America~ by Charles Adams who is a tax historian of sorts. Adams has pieced together a masterful historical journey into the realm of American political economy. He illustrates how Alexander Hamilton destroyed his own Federalist Party with confiscatory taxation. He shows how confiscatory tariffs provoked the South Carolina nullification crisis and eventually destroyed the voluntary Union, and put it on a collision course leading to the American Civil War. Therein, Charles Adams makes a powerful case that when the government engages in confiscatory taxation, then it provokes perilous consequences from diminished economic opportunity to fomenting taxpayer rebellions. The United States' history has been one of tax drudgery in the twentieth-century. First, the 16th Amendment passed, and gradually the tax rates climbed to astonishing rates. Then productive enterprises (or as accountants call them, c-corporations) were subjected to double taxation. In fact, after Comrade Roosevelt took office, the top marginal rate was once as high as 92%. Naturally, Ronald Reagan said he just take off work and played golf for a half of year rather than work as an income tax slave. The top marginal rate fell to 70% in 1963. Gee, how generous of that extortionist Uncle Sam to let just take 70%. The Laffer curve, which is just plan common-sense anyway, holds that there are diminishing returns for higher tax rates. So, when the level of taxation approaches higher rates, it actually lessens the revenues of the government. It's not even desirable that the government maximize revenues on the Laffer curve. Liberty and economic prosperity should be the ultimate end! If our enlightened American political leadership had any sense of tax equity at all, taxation would never exceed 10% of the GDP nor would the public sector's share of the economy. "The income tax is fulfilling the Marxist prophecy that the surest way to destroy a capitalist society is by steeply graduated taxes on income and heavy levies upon the estates of people when they die." --T. Coleman Andrews, former IRS Commissioner

The Only Certain Things in Life: Taxes, and more Taxes

Published by Thriftbooks.com User , 18 years ago

Author Charles Adams is a former lecturer at UCLA and a tax consultant with the CATO Institute, a Washington D.C. Think Tank. He has written many publications on the subject of taxes, with most all of them attacking the present system of income tax and discussing ways to improve the system of internal revenue collection. This book is mostly a lesson in history and it explains in detail how certain taxes came into being and how the American people reacted. Much of the coverage here is old news, like the Sugar Act, the Stamp Act, and the protests that led to the American Revolution. But then there are other taxes that are not so well- known, like the tariffs that led to the Civil War in the 1800's. Most people think the Civil War was fought over slavery, but this was only one reason among many. Adams shows how Lincoln deliberately used taxes to antagonize the South, leading ultimately to war, which was exactly what he wanted. The income tax is the one that most Americans know best, because it's the tax that everyone pays at present. Woodrow Wilson was president when the income tax became law. Officials who passed the tax swore that it would never be greater than a few percentage points and it would never be levied against anyone except the very wealthy. Of course, as everyone knows, this was a blatant lie to sell the plan to the states and to the general public. Once the ability to tax was in place, it was only a matter of a few years before it expanded and grew to several times the original level. Adams talks at length about the deceptions used by politicians to get this and other taxes enacted. Adams spends most of the book talking about the income tax and possible alternatives to the tax. One part of the book is titled "The tyranny of the income tax, 1913 to 199?". This book was published in 1998. Adams was being very optimistic if he thought the income tax would be a thing of the past only 1 year after he published his book. The use of the question mark shows his optimism that the income tax will be replaced with a different system of taxation at some point in the near future. This book is a fairly quick read. The print is larger than normal and many of the pages include illustrations, with political cartoons and photos from the past, mocking the government's position on taxation. The cartoons are mostly humorous in nature, and they depict different political figures and other people talking cynically about different taxes and their affects on the people. Overall, this is a good book about the issue of taxation and rebellion. It's obviously biased against taxes, but author Charles Adams maintains a level of respect throughout, stating some of the facts about taxes and offering up alternatives to the present system. He doesn't resort to name- calling, like some other authors. You can tell that Adams is no friend of taxation, but he basically lets you, the reader, decide for yourself about this difficult issue and how it has affected Am

Entertaining vignettes of citizens resisting the taxman

Published by Thriftbooks.com User , 20 years ago

This book is for general reading and should not be confused with a scholarly history of taxation. It is a series of chapters that are brief retellings of various historical incidents involving citizens resisting taxation in various ways or citizens being made to suffer through taxation programs. These tellings do have a point of view and historians may find some of them rather blunt and ignoring certain subtleties that might mitigate some of the author's point of view. However, in total the book does make its point that it is up to the citizens to hold the government responsible for its spending and the taxation it levies to pay for that spending. While I abhor taxation beyond what is absolutely necessary, I think all the arguments about taxes actually function to distract us from the real thing we should be debating and that is government spending. The problem is that the modern state has so many of us on the receiving end of this or that program that we will resist any program that decreases the increase in our program's spending (let alone any actual cuts). So, when someone proposes ANY cut in spending, those being cut raise a loud resistance effort to defeat it. This is why we try and starve the government by cutting taxes - the hope being that the starved beast will not be able to increase the handouts without limit. Anyway, this can be an entertaining read. There is a list for further reading and an index. Just don't take everything in here as gospel.

one of the best histories I've read in a while

Published by Thriftbooks.com User , 24 years ago

This book lay on my shelf some time before I finally got to it. Probably the word "taxes" sounds of bordom and generally negative overtones, but as I finish this book tonight I have found that I thoroughly enjoyed it. I highly recommend it to the history buff and tax-hater in all of us, excepting democrats [socialist], of course. The chapters dealing with the War for Southern Independence are especially interesting: Lincoln and the so-called moral North get a good ol woodshed whooping. One they deserve--for we all know that money and not morals has always been their priority. A great great book.