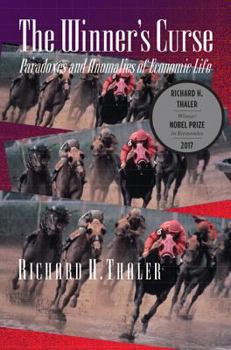

The Winner's Curse: Paradoxes and Anomalies of Economic Life

Select Format

Select Condition

Book Overview

In this book, Nobel Prize-winning economist Richard Thaler challenges the received economic wisdom by revealing many of the paradoxes that abound even in the most painstakingly constructed transactions. He presents literate, challenging, and often funny examples of such anomalies as why the winners at auctions are often the real losers--they pay too much and suffer the winner's curse--why gamblers bet on long shots at the end of a losing day, why...

Format:Paperback

Language:English

ISBN:0691019347

ISBN13:9780691019345

Release Date:January 1994

Publisher:Princeton University Press

Length:240 Pages

Weight:0.80 lbs.

Dimensions:0.6" x 6.1" x 9.2"

Customer Reviews

5 ratings

Highly Recommended!

Published by Thriftbooks.com User , 19 years ago

We highly recommend this classic of economic literature, one of the first (more or less) accessible presentations of the evidence against economic rationality. Economists have assumed, conventionally, that economic choice rests on a foundation of rationality. For instance, economists tend to think that people will put the same value on two mathematically identical offers. Yet laboratory experiments have proven what everyday experience suggests: people are not quite rational. Author Richard H. Thaler, a founding father of behavioral economics, presents convincing exhibits to make the case that the assumption of economic rationality is an awfully big pill to swallow. Stylistically, his book strikes a neat balance between accessibility and obscurity. A reader will need a certain amount of schooling in economics and a great deal of patience with academic prose to wade through every word of every chapter, although the payoff is substantial. However, it is possible for the impatient reader to get the gist by reading the introduction, the first page or two of each chapter and the epilogue. And even that is eminently worthwhile.

Intriguing for the academic mind

Published by Thriftbooks.com User , 20 years ago

Most anyone will find this discussion of Thaler's (and his colleagues) work enough to whet their appetite for more on the subject. It is only a matter of time before you will find yourself digging up the academic papers behind the discussions. My only complaint: the supporting books by Kahneman and Tversky are expensive!

How to make money in a pub?

Published by Thriftbooks.com User , 23 years ago

How rational are human beings or how close to the economic models do they act? This book is a collection of articles by Professor Thaler which shows that we quite usually don't behave like theory predicts. Thaler's extensive research (the references are 30 pages long) gives The Winner's Curse a great academic foundation, but its maths that can be skipped and easy language makes the book acessible - and enjoyable - for every one that is just interested in Economics. To sum up, if you are studying or working with Economics, you should read this book. It will help you to be skeptical about the theory - just like every scientist should be. If you are reading it just by curiosity, it will enhance your skills when your are talking about the economy at a local pub. Actually, The Winner's Curse teaches you how to make money even in a pub. It worths the money. It's an excellent book.

Economic behavior puzzles the experts

Published by Thriftbooks.com User , 24 years ago

Much more fun to read than I expected. I am generally put off by economics books, but this one turned into a fascinating read.The Winner's Curse lists a series of economic anomalies, the title being one of them. Thaler calls them anomalies since each defies 'classical' economic theory, generally the notion that markets are efficient and participants know what they are doing. Since few would accuse me of knowing what I'm doing when buying stocks, I find myself happily agreeing with Thaler's digs at Ivory tower economists.The "winner's curse" anomaly is the notion that people who 'bid to win' at an auction, are often sorry that they won. My favorite anomalies included 'loss adversion' (we remember financial disasters, not successes), 'Intertemporal Choice' (our mental 'rate of return' analysis baffles the experts), 'the favorite factor' (yes, bet on the favorite!), and 'calendar effects' (forget about random walks down Wall Street).

Thoughtful but stimulating exploration of consumer behavior

Published by Thriftbooks.com User , 27 years ago

This book is an excellent introduction to consumer behavior, especially behavioral finance. While it reads at times like an anthology, the book covers many discrete aspects of consumer behavior. By consumer behavior, it is meant consumer risk-taking. Many solid examples, especially in the financial arena. If you are a contrarian investor, then this book is for you--identifying why the "herd" often behaves in the manner that it does with respect to financial decisions. This book will pay for itself many times over, if only you apply it to future investment decisions