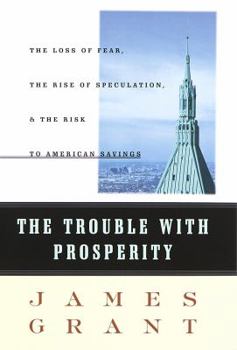

The Trouble with Prosperity: A Contrarian's Tale of Boom, Bust and Speculation

Select Format

Select Condition

Book Overview

This text examines the role failure plays in ensuring continued success of financial markets. By examining and explaining a 70-year cycle of boom and bust, the author claims that the stock market is... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0812924398

ISBN13:9780812924398

Release Date:October 1996

Publisher:Crown Publishing Group (NY)

Length:348 Pages

Weight:1.38 lbs.

Dimensions:1.2" x 6.5" x 9.6"

Customer Reviews

4 ratings

Excellent Account of Speculative Folly

Published by Thriftbooks.com User , 15 years ago

I first bought my paperback edition of this book back around 1996 when it came out. Being somewhat uninformed at the time about the wonders of modern day finance, I read it with something less than full comprehension. The author, James Grant, assumes that his reader has a fair acquaintance with the ways of Wall Street. I've re-read it at least twice since then, gaining greater understanding with each re-reading. The book holds up remarkably well. As far as I can see, all of his Cassandra-like warnings about the speculative excesses of Wall Street in the 1980's and 1990's prior to 1996 are every bit as applicable to today's present financial disaster. American investors--and probably most human investors--appear to have gnat like memory spans. Economic history appears to be a field of human understanding little studied or understood by the investor community. Optimism blooms eternally in the soul of the American investor. Grant holds that the business cycle is unlikely to ever be superseded despite claims to the contrary, "That it is really different this time...." This is a claim that is asserted throughout financial history. If you want good financial advice and insight, I would say Mr. Grant has a very good track record if the prognostic accuracy of this book is any indication. The author does seem to have a rather romantic and sentimental attachment to the old gold standard financial days. He never comes out and recommends it for this modern age, but I do detect a flirtation. I can't go there with him on that one, though. And he seems to have little faith in financial regulation. I'm really not in agreement with him on that, either. We certainly can do better than we've done in the past few decades of de-regulation. We cannot do away with the business cycle, but we should be able to let a little air our of financial bubbles instead of pumping them up in Greenspan fashion. All in all, a well written, very informative, and very humorous book. Highly recommended! Hopefully, the publisher will put out a new edition of this book to deflate the bubble of excessive prices for copies of this used book.

Markets are inevitable, irresistible, and indispensable.

Published by Thriftbooks.com User , 18 years ago

Record levels in marginal debt, speculation frenzy, and risk ceasing to have negative implications because financial prosperity suggested a lack of business volatility, as financial authorities stamped out emerging crisis and characterized financial prosperity, in 1996. Stability had become the goal of national economic policy. The fed fixed the 1994, Mexico Peso devaluation crisis and at the about the same time removed unwanted fluctuations in the commodities market; in 1996, the US government's intervention in oil and cattle markets drove upward adjustments in price; intervention in the copper market by Bank of Japan, Bank of England and help from regulatory authorities of United Kingdom and US coordinated policy and price for copper. Feats of macroeconomic management have only deepened the faith of steady returns through patient investment. Money poured into equity mutual funds in the 1996s but the equity never came. The growing faith for stability became a powerful force for instability. Adding equipment for growth does not create value; this can and will lead to over capacity; what is needed is an increase in productivity that matches demand. Markets are inevitable, irresistible, and indispensable. Even if a central bank could create a state of economic perfection, measure out growth in the ideal, and control non-inflationary does of money supply; humans would respond by overpaying for stocks and bonds and would not stop until painful overvaluation occurred, as the marginal rate of return would fall short of expectation and the price return to the mean. The function of Bear markets and cyclical down turns is cut short price error. In the 1990s, the Fed discount rate stood at 3% and caused a stock boom that saved the banks. The stock market boom was touched off by low interest rates. The Fed had bailout the Bank of New England previously and the boom helped the New England economy recover and equity capital grew propelling bank earnings to reach 10.5% per annum. The Stock market started worrying about bank prosperity and FDIC was overflowing with funds reviving from near bankruptcy. Banks implemented prosperity attenuation plans 1) repurchased their own stock 2) merged with other banks 3) and stepped up dividends attempting to neutralize capital. Investors began driving up the P/E of small banks betting they would merge with bigger banks. The big banks had lower valuation of shares and fatter dividends than the smaller banks. The 1980s there were 4,185 national banks with $114 billion in equity and by 1995, the national bank number had dropped to 2,861 with $190 billions of equity. In the 90s, it was believed that $35 billion of equity would be paid out in dividends leaving a $65 billion problem. Shareholders wanted the benefits of compounding of their equity. Marginal interest rates were cheap but not so cheap as to attract clients leading from a boom to a bust. Too much lending would lead to distortions in the credit

Superb financial history by a witty writer.

Published by Thriftbooks.com User , 27 years ago

For an extensive and mostly favorable review of Mr. Grant's, The Trouble with Prosperity, by an economist that shares Mr. Grants's sympathies with the Austrian school of econoimics go to the following URL:

Grant again shows mastery of market history

Published by Thriftbooks.com User , 27 years ago

Mr. Grant's book is good and again he demonstrates great knowledge of the history of financial markets. His writing can be a little bit dry at times, making it sometimes difficult to follow the thread of argument in each chapter. Grant gives a compelling case that the cyclical nature of booms and busts isn't over and suggests several times that these cycles are really beneficial to a country's economic health. He suggests that efforts by governments (notably the Japanese) to suppress the effects of natural market cycles inevitably lead to disaster. I think, however, his thesis is undercut by his own research that suggests that moderate economic expansions yield only moderate economic contractions. Several times he suggests that we should strive for stronger expansions, thereby ultimately leading to more severe contractions, but never really provides a compelling case as to why. In other words, Grant does not present persuasive reasons as to why moderate economic cylces are inferior. In any event, this is another first rate book by Grant. I strongly recommend it for those people who think markets (and economies) only go UP