Theorie des Geldes und der Umlaufsmittel

Select Format

Select Condition

Book Overview

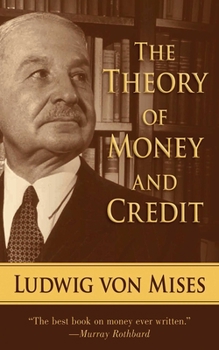

"It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments." - from The Theory of Money and Credit Originally published in 1912, Ludwig von Mises's The Theory of Money and Credit remains today one of economic theory's most influential and controversial treatises. Von Mises's examination into monetary theory changed forever the world of economic thought when he successfully integrated "macroeconomics" into "microeconomics" --previously deemed an impossible task --as well as offering explanations into the origin, value and future of money. One hundred years later, von Mises and the Austrian school of economic theory are still fiercely debated by world economists in their search for the solution to America's current financial crisis. His theorems continue to inspire politicians and market experts who aim to raise up the common man and reduce the financial power of governments. In a preface added in 1952, von Mises urges the people of the world to see economic truth: "The great inflations of our age are not acts of God. They are man-made or, to say it bluntly, government-made. They are the off-shoots of doctrines that ascribe to governments the magic power of creating wealth out of nothing and of making people happy by raising the 'national income.'" "The best book on money ever written." --Murray Rothbard, economist and historian "The greatest economist of the twentieth century." --Sandeep Jaitly, economist

Format:Paperback

Language:English

ISBN:1620871610

ISBN13:9781620871614

Release Date:August 2013

Publisher:Skyhorse Publishing

Length:496 Pages

Weight:1.28 lbs.

Dimensions:1.2" x 5.5" x 8.1"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

5 ratings

Essential Reading For Understanding Money & Banking

Published by Thriftbooks.com User , 15 years ago

After just completing my 2nd read of this text, all I can say is Wow. This is not a fast or light read, and I found myself marking up the margins with notes to keep pace. At times it can be wordy and Von Mises is arguably prone to going off on tangents to prove a circular point. If you are committed to understanding money and are willing to invest the time and energy, then this will be a very rewarding investigation that will shed some light on aspects of our current problems. In many respects this is a deeply philosophical explanation of money. He begins with the types and functions of money and its measurements of value. "When the free-exchange of goods and services in unknown, money is unwanted" he says. He does offer a simple definition before expanding into finer theory, "The function of money is to facilitate the business of the market by acting as a common medium of exchange." There is good discussion on aspects of gold reserves and fiat currencies, and in particular commits a considerable portion of the book to defining the value of money. I particularly enjoyed reading about Von Mises perspective on how socialism is an "enemy" of money, when production and distribution are systematically regulated by a central body. The banking section is very relevant to better understanding our current banking crisis. In this he admits that the Austrian School did not inquire thoroughly into what consequences follow unrestricted extensions of credit or whether it is possible for banks to permanently depress the natural rate of interest. Instead it was content to investigate what would happen if 1 country's banks extended the issue of fiduciary media more than banks in other countries; arriving at the doctrine of "external drain" relating to the English crisis of the mid-19th century. Von Mises then relates "more recent history" (the book was published in 1934 and updated in 1953, he died in 1973) stating "banks have never gone as far as they might in extending credit and expanding the issue of fiduciary media. They have always left off long before reaching this limit, whether because of uneasiness or on the part of those who had not forgotten earlier crises, or because they had to defer to legislative regulations concerning maximum circulation....in only this sense we can interpret that it is apparently true that restriction of loans is the cause of economic crises, or at least their immediate impulse; that if banks would only go on reducing the rate of interest on loans they could continue to postpone the collapse of the market....Certainly the banks may postpone the collapse; but nevertheless the moment must eventually come when no further extension of the circulation of fiduciary media is possible. Then the catastrophe occurs, and its consequences are the worse and the reaction against the bull tendency of the market the stronger, the longer the period during which the rate of interest on loans has been below the natural rate of int

The Genesis of Modern Austrian Economics

Published by Thriftbooks.com User , 16 years ago

The Theory of Money and Credit is the foundation of modern Austrian Economics. The central contribution of this book is its application of marginal utility theory to money. Mises takes a micro-analytic approach to money that differs from the Hume-Fischer-Friedman Quantity Theory significantly. Of course there is some truth in the Quantity Theory. The Quantity Theory also teaches some lessons against inflation. Mises set the groundwork for Austrian Business Cycle theory, as later developed by Hayek and Garrison. Both the Quantity Theory and the Mises-Hayek theory of trade cycles point to the same root cause: inflation. However, the Mises-Hayek theory explains trade cycles in terms of intertemporal dis-coordination. Hayek owes his Nobel Prize the groundbreaking work of Mises. The Theory of Money and Credit also served as the basis for the calculation critique of socialism. Mises began to see the significance of monetary calculation in this book. The Austrian theories of the trade cycle and monetary calculation are the two main lines of modern Austrian research. These were the two critical debates of the Interwar Years. Also, Mises formulated his `Regression Theorem' in this book. Without this book, the modern Austrian paradigm would differ beyond recognition. Anyone who wants to learn Austrian economics should read this book.

The Best Book on Money & Credit Ever Written? ... Possibly!

Published by Thriftbooks.com User , 18 years ago

Murray Newton Rothbard has been quoted as saying this book is THE best book ever written on Money & Credit. So having found Rothbard's writings to be outstanding in their own right, I moved on to this Mises classic! The first thing to note is that this book was first published in 1912 and in German, and although the translation has been accomplished superbly, the style of writing has somewhat of an antequated feel to it; not quite the same free flowing prose you get with Rothbard. Once you get into the feel of it though, this in no way detracts from your understanding of the theory presented. It has an excellent new Foreward by Rothbard himself, extensive footnoting and index and is hardbound beautifully by the Liberty Fund Press, with dust jacket. There is also a nice Appendix: On The Classification of Monetary Theories, that is very useful and informative. The book itself is divided into four main Parts: Part One: The Nature of Money. Part Two: The Value of Money. Part Three: Money and Banking. Part Four: Monetary Reconstruction.(This part was added in 1952). For me the book really took on a story of two halves. In the first half of the book, Parts 1 & 2, the bulk of the theory is really laid out. It can be slow going as it is extremely in depth but I highly recommend you stick with it as this pays off in the second half of the book! In Part 3 Mises really starts putting flesh onto the theory when we get into Money & Banking proper with discussion of demand for money, credit, fiduciary paper, rate of interest etc. But towards the end in Chapters 19 & 20 things get MUCH more interesting as equilibrium rates and interest are discussed in detail and he finally talks about gold, the gold standard and banking freedom. Part 4 is where my heart lies. Here we have the discussion of the principles of sound money versus contemporary currency systems. There's then an excellent discourse on the Return to Sound Money, ie the Classical Gold Standard. The second half of this wonderful book certainly flowed better for me, but that may also be just because I am more of an investment manager/trader and less of an economist! You feel like you have had Mises teaching you in fine detail and that he has left no stone unturned in your understanding. Mises doesn't read as easily as the prose of Rothbard but that does not detract from the excellence of the material. Superb! It really IS a truly outstanding work and if not the best book ever written on the subject, it surely has to be at the very least, one of the very best, and as such is certainly a "must-read"!!! This wonderful, beautifully bound, classic is an absolute "steal" at $20. I still cannot believe it is sold for so little. My recommendation is to buy it while it is still available in this beautiful hardbound edition! Enjoy!

Fascinating and groundbreaking.

Published by Thriftbooks.com User , 24 years ago

The late great Murray Rothbard described Ludwig von Mises's _The Theory of Money and Credit_ as the best book on money ever written. And so it is.It is probably best known as the volume which first set out the distinctive Austrian theory of the trade cycle. For that alone, it deserves a place on the bookshelf of everyone who cares about such things (and more people should).But there's much more to it than that. This volume sets out a complete and groundbreaking theory of money itself: what it is, where it comes from, what it means to speak of its "value," the differences between commodity money and fiat money, the demand for money and what it has to do with banking, and -- crucially -- the jiggery-pokery that becomes possible when the State starts messing around with unsound monetary policy.This edition also includes a section on "Monetary Reconstruction" written in 1952 (and first included in the 1953 Yale University Press edition).Plus there's a foreword by Murray Rothbard. And, finally, it's another beautifully crafted volume from the Liberty Fund, practically a steal at the price posted above. You'd have a hard time buying most such books _used_ at this price.So what are you waiting for? Throw your Samuelson and Keynes in the trash and pick up a book of _real_ economics.

Brilliant and Persuasive

Published by Thriftbooks.com User , 26 years ago

This is the first of the modern works to identify the cause of the business cycle: artificial credit expansion sending miscues to capital goods industries. Though written in 1912, it retains its persuasive power, especially in light of the current financial meltdown. Mises also covers the origin and nature of money and banking. As always LibertyFund puts out a beautiful book.