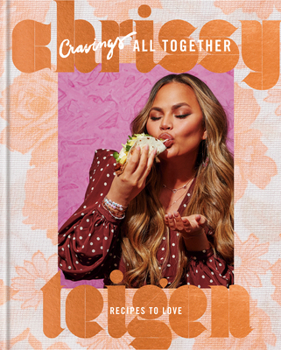

Cravings: All Together: Recipes to Love

(Book #3 in the Cravings Series)

Select Format

Select Condition

You Might Also Enjoy

Book Overview

Chrissy Teigen has always found a big sense of fun in the kitchen, but more than ever, she turns to the stove for comfort and warmth. Now Chrissy shares the recipes that have sustained her and her family, the ones that made her feel like everything is going to be okay. Recipes for Cozy Classic Red Lentil Soup, ingenious Chrissy signatures like Stuffed PB&J French Toast and puff pastry-wrapped Meatloaf Wellington, and family favorites like her mom Pepper's Thai-style Sloppy Joes and John's Saturday-morning Blueberry Buttermilk Pancakes will have you feeling like you're pulling up a chair to her table.

Customer Reviews

Rated 5 starsTy Dye

His name is Charlie Bone, and he is a 12 year old boy going to Bloor's Academy. Plus he's nothing close to customary and Charlie knows he has a gift and he uses it against the evil in his town. But when the evil kids with powers try to release a desperate evil shadow from a painting, he doesn't know if he can stop them this time. Charlie, a descendant of the Red King, has an endowment which allows him to travel into paintings...

0Report

Rated 5 starscharlie Bone and the shadow

Charlie Bone and the shadow Orchard Books 2008,$12.99 Jenny Nimmo 13:978-0-439-84669-1 His name is Charlie Bone, and he is a 12 year old boy going to Bloor's Academy. Plus he's nothing close to customary and Charlie knows he has a gift and he uses it against the evil in his town. But when the evil kids with...

0Report

Rated 5 starsLove it!

I am 16 and have followed Charlie Bone since the series came out. I love these books and I think they are great for any age. The characters are so relatable, and I have always told anyone who would listen that I would want to play Olivia if they ever made a movie. Now I am a bit old, but would still love to.

0Report

Rated 5 starsAwesome Book!

This book was really good. I love the Charlie Bone series, now that there is no Harry Potter to look forward to these are the next best thing. They are children's books, but, just like Harry Potter and Little House on the Prairie they are very entertaining for adults also.

0Report

Rated 5 starsCharlie Bone and the Shadow

Charlie Bone and the Shadow by Jenny Nimmo was a great addition to her series. I teach Science and also run the Literary Guild Reading Club for our school. So I like to read what the kids are reading. I also like to be able to recommend books to them that I think they will like. I have enjoyed the Charlie Bone series. Her writing is easily read and she has a nice use of words. The characters are well developed and the students...

0Report