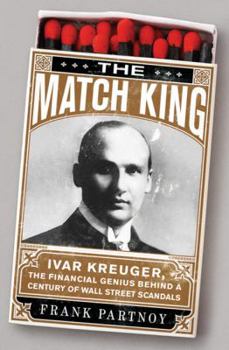

The Match King: Ivar Kreuger, the Financial Genius Behind a Century of Wall Street Scandals

Select Format

Select Condition

Book Overview

At the height of the roaring '20s, Swedish 'migr' Ivar Kreuger made a fortune raising money in America and loaning it to Europe in exchange for matchstick monopolies. His enterprise was a rare success... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1586487434

ISBN13:9781586487430

Release Date:April 2009

Publisher:PublicAffairs

Length:272 Pages

Weight:1.14 lbs.

Dimensions:1.0" x 6.3" x 9.3"

Customer Reviews

5 ratings

Extremely interesting book but with limited scope

Published by Thriftbooks.com User , 15 years ago

Early in this book there is a breathtaking paragraph. It is not breathtaking due to wording or emotion. Rather it is breathtaking because it starts with Ivar Kreuger (1880-1932) in high school and ends with him twenty five years later owning worldwide match, construction and film empires. All in one paragraph. Clearly this book is not a biography in any sense of the word but is properly classified as a business history. The author, Frank Partnoy, is focused on the last decade of Krueger's life when Kreuger was striking deals to lend money to governments in return for monopolies in producing and selling matches. This strategy put him in conflict with traditional bankers, such as the J.P. Morgan company, and required Kreuger to raise huge amounts of money in Wall Street. The vast bulk of the book is concerned with these transactions and how Kreuger achieved them. Unfortunately there was a large element of fraud associated with the transactions. Kreuger's financial statements were manipulated to show profits and assets which weren't there. However the main interest in the book is how Kreuger also manipulated the auditors, investment bankers, commercial bankers and directors to facilitate his frauds. Kreuger used his intelligence, charm and networking to cater to their greed, ego and ignorance. The author tries to position Kreuger as the pioneer in Wall Street fraud and attempts to show that his "innovations" come down to the current day. Having read to book I would say that case was "not proven". Financial fraud has existed for eternity and without a sweeping review of its history, which this book is not, it is impossible to say who was first in any innovations. The fact that the author references Bernie Madoff or uses trendy terms (i.e. "derivatives" instead of the centuries old "puts", "special purpose" companies instead of the centuries old "non-consolidated" subsidiaries) may prove recurring patterns of fraud but not that Kreuger invented them. Clearly the co-opting of those "independent" professionls responsible for monitoring or controlling companies is a recurring theme of many frauds. So is Kreuger's ultimate downfall and suicide as a faltering economy lays bare his need for cash despite the reported profits. The book is well written and organized. The author clearly benefits from the extensive documentation arising from the major investigations which followed Kreuger's failure. However, to reiterate, this all relates to the last decade of Kreuger's business life. Images of the man himself are fairly clear in the book but how he got that way is largely a mystery since the book doesn't address whole decades of his early business life. Some commentators have highlighted incidents, such as his involvement in Greta Garbo's early film career, but frankly those are just minor asides and anyone buying the book on that basis are likely to be disappointed.

An amazing true-life saga of the 1920's & 30's equivalent of Bernie Madoff

Published by Thriftbooks.com User , 15 years ago

The Match King: Ivar Kreuger, the Financial Genius Behind a Century of Wall Street Scandals is the true-life biography of Swedish emigre and 1920's financier Ivar Kreuger, who amassed an immense amount of money raising capital from American investors and loaning it to European governments in exchange for matchstick monopolies - in an era when matches were a common household staple. Even after the 1930s collapse of Wall Street, Ivar continued to make money. But in 1932 the house-of-cards nature of Kreuger's empire came to light. The unrealistically high dividends that he paid to investors had led him to adopt more convoluted an fraudulent practices, from shell companies in tax havens to "creative" accounting figures to even forgery. At last his empire could no longer sustain itself; shares of his company became worthless in a matter of hours. The "Kreuger crash" that followed provoked the bankruptcy of millions, and prompted landmark securities regulations that still protect our marketplace today. An amazing true-life saga of the 1920's & 30's equivalent of Bernie Madoff, The Match King is highly recommended to scholars and lay readers alike, especially any studying the history of financial fraud.

Ivar Kreuger Was a Crook, But He Created Value

Published by Thriftbooks.com User , 15 years ago

BOOK REVIEW: 'The Match King' Revives an Almost Forgotten Financial Figure Who Outdid Ponzi, Madoff, Stanford By David M. Kinchen Everything in life is founded on confidence -- Ivar Kreuger History is merely a list of surprises. It can only prepare us to be surprised yet again. -- Kurt Vonnegut History repeats itself, first as tragedy, second as farce. -- Karl Marx * * * Charles Ponzi, Bernard Madoff, R. Allen Stanford, Ivar Kreuger. Kreuger? Who's he? Frank Partnoy tells us about the Swedish financier who outdid Ponzi, Madoff and the Texan Standford in an elegantly written biography "The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals" (PublicAffairs, 304 pages, $26.95). Ponzi's scheme was penny ante compared with Kreuger's machinations, which resulted in a grand illusion that lasted more than a decade and saw Kreuger lending money to European governments and creating financial instruments that are still in use today. The New York Times Co., for instance, uses "B" shares, which have only a fraction of the voting power of "A" shares. This concept was created by Kreuger, as were privately customized, over-the-counter derivatives, now a multi-trillion dollar market, Partnoy says. Complex foreign exchange options were another Kreuger invention, now widely used today in transactions totaling trillions of dollars. Hybrid debentures? Kreuger invented these and they're widely used by many financial institutions and companies such as Avon. Kreuger (1880-1932) was a civil engineer by training and a financier, entrepreneur and industrialist by instinct. In 1908 he co-founded a construction company called Kreuger & Toll. In a world where wooden safety matches were a basic necessity, he built a global empire based on his Swedish Match Company. He negotiated match monopolies with European, Central American and South American governments and used these monopolies as platforms for his financial empire. Like Madoff, Ponzi and Standford, he promised and delivered -- for a relatively long time -- larger than usual dividends to his investors. Like the others, he appealed to the greed which seems to be embedded in the geneitic makeup of just about everybody. Even the Great Depression didn't slow down Kreuger; from 1929 on until his suicide in Paris in 1932, he was a rare success story, or so it seemed, at a time when the financial world was disintegrating. He was a man of great personal charm, Partnoy says. He could charm the birds out of the trees -- and money out of the wallets of his investors. Kreuger was a celebrity who dated his countrywoman Greta Garbo, built a magnificent mansion in Sweden, traveled first class on the best ocean liners and had apartments in New York and Paris. Newspapers and magazines vied for interviews and his success engendered jealousy among financial competitors, especially Jack Morgan of J.P. Morgan & Co. Biographers are always intrigued with their subjects -

Another Great Book by Partnoy

Published by Thriftbooks.com User , 15 years ago

This book is exactly the kind of financial history that the country is longing for right now. Partnoy does a masterful job telling the story of Ivar Kreuger, and while he does not spend much time connecting Kreuger's story to today's financial crisis, he does not need to. The story speaks for itself.

The book is a masterpiece...

Published by Thriftbooks.com User , 15 years ago

Rare it is that a thousand page book is beguilingly compressed into a quarter of that length when the common practice is just the reverse. The book is a delight - from encountering a thirteen year old Greta Garbo; through the marvelously depicted co-optation of an independent accountant (through his wife); the seduction of the ambitious young man who wants to be partners with the grandees of Wall Street; the description of beautiful living and working spaces; the realities of finance and personality in inter war Europe; and - above all else - the absolute insistence of the buying public to be allowed to participate in getting rich. Whether it is the slot machines or Bernie Madoff's guaranteed 8%, the packaging of oversees properties or the perfection of the tulip bulb, the dot com bubble or the limitless rise in residential real estate values, the ages have probably never produced as coherent, well organized and effective a promoter as Frank Partnoy's Ivar Krueger. The book is a masterpiece. When you read, you will marvel at the persistence and ingenuity of the research that lies behind the words. Possibly, the finest single thread is description of the way in which Krueger enlisted the loyalty of people essential to him. Yes, some he bought, but most - he beguiled. He gave people a sense of participating in something that gave them an excuse to have an expanded view of themselves. This is not a costless process and Krueger spent much solitary, and - one suspects - depressed time, time re energizing this capacity to give others a sense of being greater than they otherwise might have been. This is a story of great coherence, of childhood friends embarking together into the great world, of young professionals becoming industry models, of businesses growing and conglomerations being assembled [ Certainly, I would have liked at least another 100 pages about this!}, of finance ministers and prime ministers trying to finance public obligations. In brief, it is a great story - in light of its tragic conclusion, we need ask ourselves who is the hero and who is the thief. Partnoy recites step by step how Ivar Krueger went to a printer in Stockholm and had Italian Debt Instruments printed which he proceeded rather carelessly to sign. So. There is no suspense. And yet, there is so much else, there were real companies, real values. People lost more money in uncontroversial holdings. During the last ten years in America, we have witnessed the great industrial conglomerates being assembled - the assembler was adjudged a criminal and is in jail; we have witnessed the great financial conglomerates being assembled - the assembler is perhaps less of a hero than he once was, but the public is coughing up tens of billions of dollars to staunch the pollution; we have daily smiling reminders of the purposeful defrauding of thousands of individuals at a cost of $50 billion. Surely, we - citizens and customers - should have learned something. Partnoy's tale is perhap