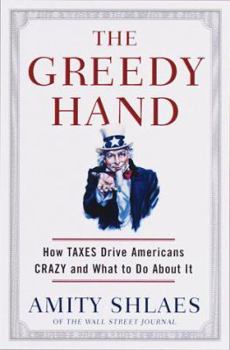

The Greedy Hand: How Taxes Drive Americans Crazy and What to Do about It

Select Format

Select Condition

Book Overview

The Greedy Handis an illuminating examination of the culture of tax and a persuasive call for reform, written by one of the nation's leading policy makers, Amity Shlaes ofThe Wall Street Journal.... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0375501320

ISBN13:9780375501326

Release Date:February 1999

Publisher:Random House (NY)

Length:255 Pages

Weight:0.99 lbs.

Dimensions:1.0" x 5.9" x 8.6"

Customer Reviews

5 ratings

An Interesting Look at How Government Takes More and More!

Published by Thriftbooks.com User , 24 years ago

The 20th century was an arms race between the governments in the United States and its citizens to determine who would control the citizens' income. Government was on the offense and the citizens were on the defense. The citizens lost to date. Taxes went from less than 5 percent of income to 40 percent over that time. Most would agree that we cannot afford another century like that one.This book nicely lays out the history of taxes that take more income and waste a lot of time and effort in the process. The author looks at sales taxes, withholding taxes at work, the marriage penalty in the income tax, whether the housing deduction for interest and taxes is a good thing or not, the problems with taxes on domestic help, property taxes and school support, the social security system, and estate taxes.She doesn't like much of what she sees, and is concerned that reform could simply lead to adding new types of taxes (like a national sales tax while keeping all of the old taxes). The newer the tax or tax idea, it seems like the worse it is working. Her solutions are basically principles to be followed in reforming taxes. I doubt if they will be followed anytime soon. Recent polls show that most Americans are concerned about paying off the national debt and fixing social security before doing anything about cutting taxes.Although most of her observations were good ones, I was a little doubtful about her automatic focus on the high income people being taken to the cleaners unfairly. There was not as much attention paid to benefits that lower income people may be receiving.If you spend time thinking about how to keep your tax bill down, there's not much new in this book. If you are new to all of the ways that government helps you spend your money, this is a good introduction to the subject.The book is well written and pleasant to read. The only drawback I found was that it was a little depressing to be reminded of how much I actually pay to all of the various governments.

Common knowledge but still incredibly eye-opening.

Published by Thriftbooks.com User , 25 years ago

Most Americans believe that their government is greedy. Those who do will still find this book earth shatering. Shlaes gives stunning examples of just how much Americans are being ripped off by the current tax code. In painstaking detail she describes how achievement, hard work, and even marriage are punished by the greed of the U.S. government. She points out very effectively that it is now possible to make too much money. When one reads this, one can't help but think that the government views them only as a revenue target. Her chapter on the I.R.S. is very enlightening. It is commonly believed that the I.R.S. is tyrannical. One would think that if it was tyrannical it would at least be effective. Shlaes really hits one out in describing just how ineffective the I.R.S. is. Also, Shlaes argues very convincingly that problems such as rising healthcare costs and the collapse of public education can, at the heart of the matter, be blamed on an inefficient tax code. Words cannot effectively state just how powerful this book is. A must read for all Americans. Maybe then some real tax reform will begin.

Informative book on the "Greedy Hand"

Published by Thriftbooks.com User , 25 years ago

Although many Americans are aware that our tax rates are high and getting higher, the "Greedy Hand", shows us just how and how much the government steals from its citizens. It is very clear that although we have a representative republic and a capitalist economy, we are behaving more and more like any socialist country in Europe. We have cast the federal government as a twisted version of Robin Hood, stealing from the "rich" and giving to the "poor". The means through which this occurs runs the gamut from payroll taxes to the bewildering concept of the progressive tax, which punishes persons who dare to make a success of themselves. I am perplexed by the 15% flat tax opponents who cry that the rich won't pay their "fair share" - although these folks shoulder over 90% of the nation's tax burden. We have only to look at our President to see how well our progressive tax (with its special provisions for the rich) is working. According to published reports, the Clintons' tax return showed over $500,000 in income, while paying taxes at a 16% tax rate. Surely our president would not disapprove of the flat tax solution, since in effect, he is already practicing it.

EDUCATION MAY BE THE ONLY WAY OUT OF THIS STALL!

Published by Thriftbooks.com User , 25 years ago

There are probably few people in the country who would disagree that the tax system needs to be seriously overhauled. But, the widely dispersed views of how to do this, the bureaucracratic proceedures required to make any change and the tradition of continuing to do things the same way, seem to prevail. What results are practices like the ones described in THE GREEDY HAND which encourage people to look for ways to reduce their tax burden - Work in one state but live in another that has a lower tax burden and buy goods in one state but ship them to another with a lower tax burden. We will have to reach "a burning platform" in this country to make significant progress, or we will have to educate those in control and teach them a process to get the information they need, reach a consensus, look at alternatives and choose one that will benefit the most people in any economic and social environment that we are likely to experience in the decades to come. This is no small task. There are some lights on the horizon, however. I have just read a wonderful new book, THE 2,000 PERCENT SOLUTION, by Donald Mitchell, Carol Coles and Robert Metz, that describes a process like this. That book also describes why people are "stalled" and unable to make progress. I urge those interested in positive change and more rapid progress to read it.

A Must Read For Every Serious Student of Capitalism.

Published by Thriftbooks.com User , 25 years ago

I am intrigued by the reviewer who stated that we don't appreciate the many services that government provides to us. The reviewer makes "a" point, but misses "the" point. The point is that American's do not freely choose those services. For example, I'd rather not have the FTC taking my tax dollars and using them to chase down value producing entities like Microsoft. I do agree that the people who ride in the cart have responsibility; however, I am concerned about the erosion of respect for private property that causes many to believe that their need is a claim on my earned assets. Electing a politician into office is not a license to confiscate property and redistribute it among those who have courted the politician's favor.