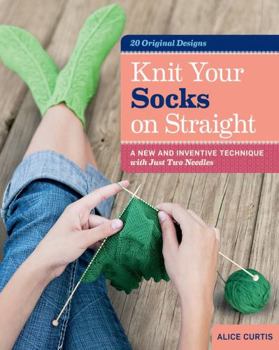

Knit Your Socks on Straight: A New and Inventive Technique with Just Two Needles

Select Format

Select Condition

Book Overview

Put those clunky double-pointed needles down and learn to knit fabulous socks on your straight needles. Sharing her groundbreaking technique for straight-knit socks, Alice Curtis provides step-by-step instructions for 20 original patterns that feature a variety of yarns and an array of motifs ranging from cables to argyle. The possibilities for creative variations are endless, and each pattern can easily be adapted to any size. Get inspired and use your straight needles to knit stylish masterpieces that will keep your feet cozy and warm.

Format:Hardcover

Language:English

ISBN:047004389X

ISBN13:9780470043899

Release Date:April 2007

Publisher:Wiley

Length:208 Pages

Weight:0.88 lbs.

Dimensions:0.8" x 6.4" x 9.1"

You Might Also Enjoy

Customer Reviews

5 customer ratings | 5 reviews

There are currently no reviews. Be the first to review this work.