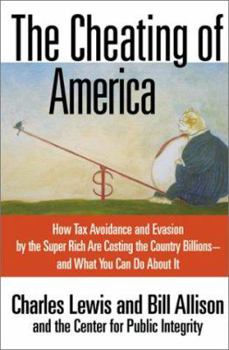

The Cheating of America: How Tax Avoidance and Evasion by the Super Rich Are Costing the Country Billions--And What You Can Do about It

Select Format

Select Condition

Book Overview

Each year millions of income-earning adults and corporations do not pay their fair share of federal income taxes -- whether legally (tax avoidance), illegally (tax evasion), or through shady means (tax "avoision"), and their numbers are rising dramatically. In this explosive book, Charles Lewis, founder and executive director of the Center for Public Integrity, and Bill Allison, a former researcher at the Philadelphia Inquirer finger these culprits...

Format:Hardcover

Language:English

ISBN:038097682X

ISBN13:9780380976829

Release Date:March 2001

Publisher:William Morrow & Company

Length:320 Pages

Weight:1.35 lbs.

Dimensions:1.1" x 6.4" x 9.6"

Customer Reviews

5 ratings

A Study of Tax Evasion By The Super Affluent

Published by Thriftbooks.com User , 19 years ago

"The Cheating Of America: How Tax Avoidance And Evasion by the Super Rich Are Costing the Country Billions-And What You Can Do About It" by Charles Lewis, Bill Allison, et. al., is a well-researched overview of how some of America's wealthiest citizens and corporations avoid and evade taxation. "The Cheating Of America" tells us that at least $195 billion a year in taxes isn't collected from the ultra-wealthy. This means the amounts collected from honest affluent people, middle-class earners, and low-income people are invariably higher. If all the rich paid their taxes, it's estimated the average taxpayer wouldn't have to pay thousands of dollars per year in extra taxes to make up the tax shortfall. While $1.5 billion in new wealth is created every day in the U.S., we learn the number of full-time workers living in poverty has increased from 459,000 in 1998 to over 2.8 million in 2001. A few of the issues: --American companies legally open non-U.S. corporations to hold non-U.S. profits. But, these companies often engage in illegal pricing schemes to inflate their foreign profits at the expense of U.S. profits, effectively transferring taxable income to the foreign corporation. In the 1950's, corporate taxes comprised 27% of the tax revenue. By the 1990's, corporate taxes only made up about 10% of the federal tax revenue. That's about a 2/3 decrease in corporate taxes. Individual taxpayers must make up the difference. --Nonprofit Organizations operating businesses. The book estimates that non-profits control $1.3 trillion in wealth. While many nonprofits are legitimate, many aren't. The authors write: "...the precedent for using the cover of benefiting mankind to avoid taxes has a long, rich tradition. ... Howard Hughes, for example, set up the Howard Hughes Medical Institute, which owned the stock of his aircraft manufacturing corporation. The nonprofit medical institute gave hardly any money to charity during his lifetime, unless one considers bankrolling the reclusive lifestyle of Hughes a charitable purpose." Some of these nonprofits are lobbying organizations and industry promotional groups (For example, lobbying for deregulation and tax cuts). --Corporate use of "phantom losses" from transactions that lack economic substance. The Cheating Of America does a good job of discussing the problems with international banking and how some companies create many entities to try to confuse the IRS. The secretive nature of some foreign country banks makes it nearly impossible for the IRS to obtain the records it needs to properly evaluate a business's tax situation. It's estimated that $10 billion a year in tax revenue is lost to this type of tax shelter. For example, sometimes, some foreign bank will "loan" a wealthy individual money. That money is really taxable income in disguise. And, interest payments on the "loan" are sometimes reported as tax-deductible, if the "loan" is disguised as a mortgage or business loan. --Wealthy individuals

Muckracking Expose

Published by Thriftbooks.com User , 19 years ago

Calling this "left-wing propaganda" and other editorial commentary in some reviews really just proves the premise that as America slips into decline, the only 'wealth' being created is tax cheating schemes, along with 'no-down-payment' real estate speculating courses, and "privatization" of public property such as utilities, or government research. This book has the scoop on all the famous tax cheat schemes, and consumer warnings against get involved in them. But precious little recommendations on how to solve the problem. But the main message of the book is that making money in America is no longer about producing a product, or providing a service, but about cheating on your income tax. Pretty much the USA is on the road toward becoming a corrupt third world bananna republic, like Mexico.

Great Insight into wealthy thieves...the USA is at Risk

Published by Thriftbooks.com User , 22 years ago

Thank you to the authors for their investigative approach to this book and highlighting the money trail. We have to stop the madness...Enron, Worldcom and Arther Anderson and even the execs that run these companies and the non-profits. Doesn't anyone think that "Character Counts" anymore. I like the fact that the book names the biggest offenders and how they do it.

A day in the life of the fat cats. . . .

Published by Thriftbooks.com User , 22 years ago

The Cheating of America is another superb peice of work by Chuck Lewis and his folks at the Center for Public Integrity. The CPIers reveal (once again) the exploits of the wealthy by constantly asking the question is it tax avoidance, tax evasion or somthing hazy in the middle which is refered to as avoision. The book highlights cases of people who simply aren't paying tax. The Center for Public Integrity doing what it does best . . . .taking every day public documents and going through them with a fine tooth comb - the forgotten art of investigative journalism. KEEP UP THE GOOD WORK!

Great premise, decent effort

Published by Thriftbooks.com User , 23 years ago

Unlike the other reviewers, I liked this book. My biggest problem with it is its length. After hearing a few of the stories, it started to get a bit dull.In a nutshell, this book is about people who have the money, power and lack of ethics to avoid paying their taxes. The result, of course, is that the rest of us have to make up the hundreds of billions of dollars lost. This is muckraking in the best sense of the word. This book follows a middle class self-employed taxpayer through the bureaucratic hell caused by bad IRS advice, and her resulting tax bill and then contrasts it with the treatment big-time tax evaders get. If you are an ordinary person, the IRS will go after you. If you can afford fancy lawyers, the IRS is willing to compromise on pennies for the dollar.This book is a better skim than a read, but it's an important message and the authors have clearly put a lot of work into it.