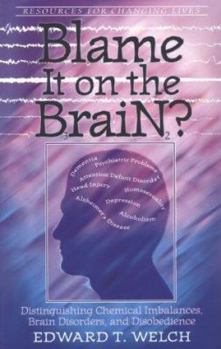

Blame It on the Brain?: Distinguishing Chemical Imbalances, Brain Disorders, and Disobedience (Resources for Changing Lives)

Select Format

Select Condition

More by Scott Berkun

Book Overview

Viewing brain problems through the lens of Scripture, Welch distinguishes genuine brain disorders from disorders that may not be rooted in the brain. Understanding that distinction will enable pastors, counselors, families, and other concerned believers to know the extent of a person's responsibility.

Format:Paperback

Language:English

ISBN:0875526020

ISBN13:9780875526027

Release Date:June 1998

Publisher:P & R Publishing

Length:208 Pages

Weight:0.57 lbs.

Dimensions:0.6" x 5.5" x 8.5"

You Might Also Enjoy

Customer Reviews

7 customer ratings | 5 reviews

There are currently no reviews. Be the first to review this work.