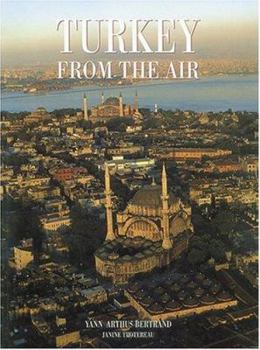

Turkey from the Air

Select Format

Select Condition

You Might Also Enjoy

Book Overview

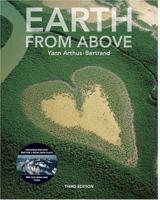

Acclaimed photographer Yann Arthus-Bertrand brings us this book of magnificent aerial photographs of the multifaceted landscapes of Turkey. Eighty-nine lush color images take the reader across some of the most beautiful terrain in the world. From the haunting remains of Hellenistic Greece and the ruins of Byzantium to the glories of the Ottoman Empire, Turkey from the Air" provides a virtual magic carpet ride through this enchanting country, including ancient sites that can be viewed only from above. We see the great city of Istanbul, once the glittering capital of the Byzantine Empire, bristling with the minarets of countless mosques. Here, too, are the ancient cities of Bodrum and Ephesus, the great theater at Aspendus, and the archaeological site Priene. The introduction provides an overview of the country's history, from the time of the Hittites, thousands of years ago, to Turkey today. For anyone who has ever been to Turkey or wishes to experience it from a unique perspective, this book of stunning aerial photography captures its extraordinary beauty.

Format:Paperback

Language:English

ISBN:0873377079

ISBN13:9780873377072

Release Date:January 2001

Publisher:NOLO

Length:400 Pages

Weight:1.36 lbs.

Dimensions:0.8" x 7.0" x 9.0"

Related Subjects

Budgeting & Money Management Business Business & Finance Business & Investing College & Education Costs College & University Consumer Law Economics Education Education & Reference Education & Training Educational Law & Legislation Financial Aid Funding Law Legal Self-Help Personal Finance Schools & Teaching Specialties Study Study & Teaching Study Aids Study Skills Studying & Workbooks Test Prep & Study Guides TextbooksMore by Yann Arthus-Bertrand

Customer Reviews

4 customer ratings | 4 reviews

There are currently no reviews. Be the first to review this work.