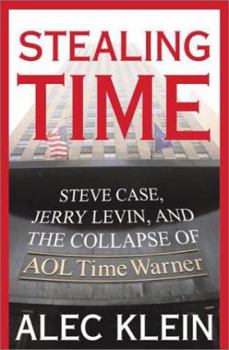

Stealing Time: Steve Case, Jerry Levin, and the Collapse of AOL Time Warner

Select Format

Select Condition

Book Overview

When America Online bought Time Warner in 2000, it was not only the largest corporate merger in history but also the much vaunted marriage of new and old media. Questions began, however, on the day the merger was announced. The stock price started a long decline; and the Federal Trade Commission subjected the merger to intense scrutiny. Securities and Exchange Commission and the Justic Department. One hundred billion dollars was lost in 2002, and...

Format:Hardcover

Language:English

ISBN:0743247868

ISBN13:9780743247863

Release Date:June 2003

Publisher:Simon & Schuster

Length:352 Pages

Weight:1.36 lbs.

Dimensions:1.1" x 6.4" x 9.5"

Customer Reviews

5 ratings

History and a Whole lot More

Published by Thriftbooks.com User , 17 years ago

First, the style of this book makes for a great and enjoyable read. The story begins with the background of an eccentric entrepreneur who has a tendency to have great ideas with a lot of flash, but a terrible habit of spending all of the money he borrows and asking for more. The idea he has come up with now is to have video games on subscribtion to people's homes. Knowing he will soon run out of money he hires his banker's brother to come on board (if we hire his brother he'll give us more money later). The banker's brother was working at Pizza Hut in marketing. His duties entailed tasting the pizza in various stores and his name was Steve Case! Through this book you can watch Steve Case go from shy and unsure business plebe to a high powered and fast moving CEO who was groomed over many years to become one of the most iconic executives of the late 20th century. There are also other details that are very interesting such as the insider trading schemes that made the AOLers very rich; investing in companies they were about to close deals with and then selling their shares as soon as the press release hit and that company's stock went up. There are stories of abusive power among the ranks and the major rivalry that came of the merger which disgruntled the Time Warner employees. This is a great book for anyone interested in business stories, and this is one most who are, are familiar with.

"Stealing Time" and Warner, Too

Published by Thriftbooks.com User , 21 years ago

A review of Simon Schuster's new book, "Stealing Time: Steve Case, Jerry Levin, and the Collapse of AOL Time Warner," by Alec Klein First, I must issue the following disclaimer: I am the "aging flower child" in Mr. Klein's new book, entitled "Stealing Time: Steve Case, Jerry Levin, and the Collapse of AOL Time Warner." That said, I think that my perspective as a spokesman for a small ISP from the Midwest allows me an overview unlike anyone else discussed in the book. Overall, "Stealing Time" has established a standard for reporting on AOL and the AOL Time Warner merger that will be hard to top. If Mr. Klein's original reporting on AOL and the merger is the first draft of history, then his new book represents a first-rate second draft. No other reporter I know has had access to more sources and actors in the AOL Time Warner drama than Mr. Klein. His coverage of the early days of Steve Case and the company that would become AOL was particularly informative for the general readership. Besides the use of impressionism, the narrative achieves a terseness and non-linear quality that does much to engage the reader. At each stage, one has to reflect on the individual anecdote and where it fits into the historical process of the current state of AOL Time Warner's evolution. Another strength of the book is the author's ability to provide well-rounded caricatures of all the various players, large and small, who peopled this technological passion play. In particular, I was captivated by the chapter entitled "AOL Versus the World," and not just because I am part of it. The cast of characters described includes the usual suspects for any large merger: dueling CEO's, a panoply of PR types, a motley collection of merger opponents, consumer groups representing various constituencies, large government agencies like the FTC and the FCC, Capitol Hill denizens, the national media, and the American public. Mr. Klein captured it all with an accuracy I can vouch for. From the beginning of October 2000 to the merger approval on January 11, 2001, the whole notion of inevitability was brushed aside by the revelation that both companies, AOL and Time Warner, were telling the politicians and regulators a half-truth about their plans to allow other ISP's access to their cable's high speed Internet product. Ultimately, the Term Sheet being sent to ISP's like Earthlink and other applicants was a contract no one could ever sign. It's anti-competitive features helped dramatize the fact that AOL Time Warner could not be trusted to execute their promise of open access. Arguably, they lost all of their creditability once the Federal Trade Commission and the Federal Communication Commission finally saw it. As I said at the time, "the term sheet was so anti-competitive that Joseph Stalin could barely have improved it." It was hardly surprising that Time Warner, then the second largest cable company in the U.S., would build an insurmountable barrier to entry. They after all

Problems with Mergers

Published by Thriftbooks.com User , 21 years ago

This book outlines many of the problems in the infamous AOL/Time Warner Merger. It gives many examples that are common even in small mergers. Having worked for the CFO of a public company, I can relate to a number of these issues. The book illustrates why this merger was doomed from the start. An interesting read.

The Spider to the Fly

Published by Thriftbooks.com User , 21 years ago

Utterly complelling, meticulously researched book on the vampiric business practices of AOL and how indifferently they participated in the demise of many smaller dot.coms. The overall destructive impact AOL may have had on the dot.com crash cannot perhaps be truely measured, but it's impossible not to be alittle awed by AOL's reckless savagery toward clients and staff alike. Couldn't put it down.

Great Read!

Published by Thriftbooks.com User , 21 years ago

Outstanding insiders view of the biggest merger in US history. Klein did his homework through good old fashioned reporting and it shows. Look for the movie next year!