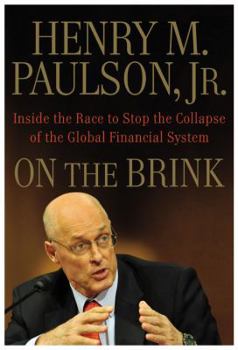

On the Brink: Inside the Race to Stop the Collapse of the Global Financial System

Select Format

Select Condition

Book Overview

When Hank Paulson, the former CEO of Goldman Sachs, was appointed in 2006 to become the nation's next Secretary of the Treasury, he knew that his move from Wall Street to Washington would be daunting and challenging. But Paulson had no idea that a year later, he would find himself at the very epicenter of the world's most cataclysmic financial crisis since the Great Depression. Major institutions including Bear Stearns, Fannie Mae, Freddie Mac, Lehman...

Format:Hardcover

Language:English

ISBN:0446561932

ISBN13:9780446561938

Release Date:February 2010

Publisher:Business Plus

Length:496 Pages

Weight:1.73 lbs.

Dimensions:2.0" x 6.5" x 9.3"

Customer Reviews

5 ratings

Page-turner

Published by Thriftbooks.com User , 14 years ago

Fascinating. A real page-turner. I followed the financial crisis closely in the Wall Street Journal and kept many articles in the E-directory labeled "Paulson's Plan," but this puts it together. It is Paulson's story but interesting regardless of point of view. My background in economics and as a former lawyer in local government surely contributed to my enjoyment of the book and identification with what went on.

They Were All Caught Off Guard

Published by Thriftbooks.com User , 14 years ago

Very interesting first person account of the financial crisis that brought the world to the brink of disaster. I found this book to be a fascinating account and very fast read. What's new? Nobody saw the crisis in its full dimensions coming and I think that is something the average American just doesn't understand. Paulson's account of the disasters that would not quit is amazing coming from a man that spent his adult life living and breathing the very system that was crumbling around him at a frenetic pace. I got a real sense of the extreme danger the entire system was in; basicly in danger of killing itself by its very nature. Thankfully Paulson and his able staff, although amazed at what was happening, understood that political ideology had to bend to the market need. Thankfully also, George W Bush stepped up to support his Treasury Secretary fully and with only minor reservations for politics. Recommended.

Eye opening shows how politics almost let the financial system fail

Published by Thriftbooks.com User , 14 years ago

Many will question his motives by those who least understand the gravity of the situation. A Republican president George Bush, along with his Treasury Secretary knew that the right course of action was to save the financial system. The biggest obstacle was their own party. The House Republicans were willing to put ideology ahead of what was best for the country. This is coming from Paulson himself not some liberal media source. What I found most fascinating was the John Boehner knew the gravity of the situation and was working with Nancy Pelosi to pass this bill. I think it goes to show that leadership is more important than populism. All the people out their who believe that these institutions should have failed are just inept at understanding the gravity of the situation. They will sight well you don't know but past history shows what happens during financial crisis of this magnitude. Look at the crisis of 1872 and the aftermath was a 12 yr depression. Also, the Great Depression is another example. George Bush did the right for once and ignored the stupid elements in his own party. Funny Paulson had very little positive things to say about McCain. In fact he criticized McCain for using the bailouts as a political tool. This is from a Republican Treasury Secretary not Limbaugh, Levin or the other ass clowns people flock too.

Enjoyed Mr. Paulson's Account Tremendously

Published by Thriftbooks.com User , 14 years ago

True, it is one man's account. And Hank Paulson is not an objective observer of the events of 2007-2008. But I certainly got the sense that the man was making a good faith attempt to be honest, transparent, and candid in his retelling of this vital story. Well-written with a mimimum of jargon. Highly recommended.

Excellent "thriller" - well worth the time.

Published by Thriftbooks.com User , 14 years ago

Hank Paulson pulls back some of the curtain that exposed his view of what took place mostly in 2008, as he battled through all manner of issues to help "save the system". This book does not explain fully how we got into the economic mess we find ourselves (it is not meant to); but this book reads like a "thriller" as Paulson writes, day by day, what happened, and the reasoning for his actions. I found the book well written, and hard to put down. Given I had read recently on Bear Sterns (Bear-Trap), and Lehman Brothers (A Colossal Failure of Common Sense), this was a nice additional book to further round out the view of what really happened. Of note, President Bush get's a lot of praise from Paulson for doing what was right, not what was expedient for his party. His interactions with John McCain and Barrack Obama, before and after the election, were illuminating. After watching last week's healthcare summit, where President Obama dressed McCain down "the election is over", some of Paulson stories seem very believable. Paulson makes very clear that Treasury, during the saving of Bear Sterns, would help protect exposed losses of any acquirer from the over valued assets. This helps make the deal for Bear Sterns doable. However, for Lehman, there is explicitly no such government support. Paulson says several times, "this deal [Lehman] is different as there was no buyer". Of course there was no buyer! When the Treasury says over and over again, "no support", what else would you expect? Paulson tried to encourage the market to save it's own competitor (privately funded pool), but that is very different to what was on offer during Bear Sterns collapse. Barclay's certainly came close to buying Lehman, but again, this came way too late in the process. If you read A Colossal Failure I get the feeling that Lehman's chairman and CEO, Dick Fauld, did not get on with Paulson. However, none of this seems reciprocated in Paulson's book. A Colossal Failure was written by an ex-employee of Lehman, so there is bound to be some sour grapes. But Dick Fauld's "they have to save me" persona seems to ring true. I get the feeling Paulson decided sometime, "We cant bail everyone out, so it might as well be Lehman that becomes the buck that breaks the cycle". The problem was no one could predict the impact. In the last chapter of Paulson's book he get's to talk about what he would do to protect the economy in the future; he talks about changes in policy, governance, and regulation. I would love to hear Paulson explore this list with Ron Paul: that should prove an interesting debate. Recommended 9 out of 10.