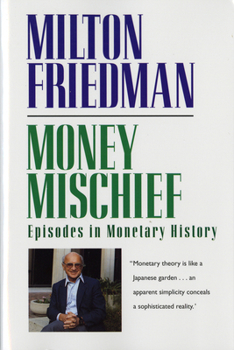

Money Mischief: Episodes in Monetary History

Select Format

Select Condition

Book Overview

"A lively, enlightening introduction to monetary history...from monetarism's most articulate apostle."--Kirkus Reviews"The Oliver Stone of economics" (Chicago Tribune), Nobel Prize laureate Milton Friedman makes clear once and for all that no one, from the local corner merchant to the Wall Street banker to the president of the United States, is immune from monetary economics. In Money Mischief, Friedman discusses the creation of value:...

Format:Paperback

Language:English

ISBN:015661930X

ISBN13:9780156619301

Release Date:March 1994

Publisher:Mariner Books

Length:304 Pages

Weight:0.69 lbs.

Dimensions:0.9" x 5.3" x 8.0"

Customer Reviews

5 ratings

Review for a Nobel Prize winner...

Published by Thriftbooks.com User , 16 years ago

Review by a non Nobel Prize winner: Dirty details of the progress of our United States Currency are the theme of this book. If you like the arithmetic to pop out as you look at text, and are one who likes absorbing and detailed accounts which provide tools for thought, you should like this collection of papers and essays on money. I did.

AIMED AT MONETARY ECONOMISTS, NOT A GENERALIST BOOK

Published by Thriftbooks.com User , 19 years ago

Many of Milton Friedman's previous books, especially "Free to Choose" are aimed at a popular audience, supporting the cause for freedom in many different aspects of society. With it, this book shares the brilliance and throughness of thought employed by Friedman, perhaps the most well known (if not the best) economist of the 2nd half of the 20th century. In "Money Mischief" Friedman enters the realm of monetary economics, briefly telling a history of the different systems that have been employed through history for value conservation. Aside from perhpas the first 100 pages, the rest of the book relies on some notion of monetary economics and international trade and finance. Most of the book is devoted to the study of the old metallic or bimetallic standards and the early days of the fiat money system (the one most used today). An experienced economist will recognize the brilliance of the arguments linkings seemingly unrelated events such as the US elections in 1892 and the fall of the Chiang Kai-shek government in China (believe me, Friedman convinced me they were directly linked). For a non-economist, the first one hundred pages may tell a brief history of money, so if that is your interest, stop there. Experienced economists will definitely enjoy the suddle linkages of events, such as deflations and the California gold rush and the development of the cyanide process for extracting gold. The book is aimed at a more knowledgeable crowd; with such an aim, it achieves its objective brilliantly.

A great introdcution to the importance of monetary policy

Published by Thriftbooks.com User , 21 years ago

I must confess of my unbounded admiration for Milton Friedman. He has contributed so much to our understanding of the effects of monetary policy and has been such a tireless advocate for freedom that I must admit I am not impartial in any way, so readers beware.This book examines 10 different episodes in world history in which seemingly trivial policy choices towards money had profound, unexpected, and unforeseen consequences (usually very bad). They make enjoyable reading and are most educational.The discussions are not all that technical and, to me, sparkle with wit and insight. This book can serve as a great introduction to how gold and silver money was abused, the effect that minting rights can have, how technology changes in mining precious metals caused a crisis of devaluation, what the heck bimetallism is and what the issues around it were (are), and most important, the risks of the kind of money we have (fiat money - because it is not tied explicitly to some kind of commodity and is therefore at the risk of somebody running the printing press too much). This is all great stuff. Enjoy!There are several useful graphs and tables. Also, a reference list in the back can act as a bibliography for further reading.

Friedman?s Case Against the Government Is Crystal Clear

Published by Thriftbooks.com User , 22 years ago

Imagine a grand winning case that is laid before the Supreme Court to change the course of modern life around the world. Friedman starts at the very beginnings of money and traces its evolution in copious detail. As proceedings finally reach the summation which is the final chapter: "Monetary Policy in a Fiat World." I see the court in a unanimous wonderment over the masterful job that has been done by Friedman. Well, the court required is public opinion--- a bit more cumbersome.In any nation at any point in modern history, inflation comes from only one source the national government, not by some physical event, war or deficit spending. He details how the cause of inflation is growing the money supply faster than the output of goods and services. In his fabulous review of money he chronicles the centuries of price stability that came to an end with the creation of paper money. This fiat money is not backed by a precious metal and it has spread becoming the only remaining currency in the world. He does not argue for the return to a precious metal standard as some have misrepresented.He provides details in country after country of how governments hallucinate that the citizens will not blame the government. Inflation directly benefits the government at the expense of the citizens. In addition to the impact on your liquid assets, the government debt is paid back or refinanced with far less valuable inflated dollars. He shows how tax cuts only giving back the tax increases that come from bracket creep in an inflationary environment. Finally. People and the financial markets quickly learn that interest rates have to compensate for inflation plus a real above inflation.In current times this means government ten year bond rates of six to eight percent or more. The last ten years was the most ideal time in a century to control inflation. However, inflation was still three to five percent per year. The only logical assumption is that in the next ten years inflation is more likely to be near five percent or more. The historical real return required on government bonds is viewed as about three percent hence the total yield of six to eight percent. Currently, it is slightly below the range. Home mortgages will tend to be a couple percent higher than the government bond. In the simplest terms, had the Federal Reserve controlled inflation to zero, mortgage rates would be half what they are today. Since Greenspan went into the job committed to zero inflation like no other Fed Chairman, there will be no realistic basis for trusting in any potential Federal Reserve policy to eliminate inflation. It would take many years of proof before bond markets would believe any such policy. Because of money mischief we are stuck with high interest rates for a very long time. Thanks to our Federal Government and no one else. The blame could not be more clear.Many governments have fallen including democracies over the matter of inflation. As USA citizens learn about inflation,

A wonderful book!

Published by Thriftbooks.com User , 24 years ago

I am not an economist. This book opened my eyes to how the government influences the economic progress of us all through money supply. It is easy to read and understand. I highly recommend it to any lay people with an interest in why we are subject to economic catastrophies. I would be very interested in other readers views on this book, so please email me at [email protected] .