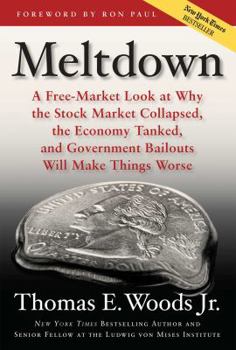

Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and the Government Bailout Will Make Things

Select Format

Select Condition

Book Overview

A NATIONAL BESTSELLER, now with a new introduction In clear, no-nonsense terms, Woods explains what led up to the 2008 economic crisis, who was really to blame, and the dangers of government bailouts.... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1596985879

ISBN13:9781596985872

Release Date:February 2009

Publisher:Regnery Publishing

Length:194 Pages

Weight:0.85 lbs.

Dimensions:0.8" x 6.0" x 9.0"

Customer Reviews

5 ratings

The Fed's Fingerprints Are All Over It

Published by Thriftbooks.com User , 15 years ago

Deregulation. Market failure. Greed. Not enough government oversight. All kinds of fallacious explanations are being trotted out as primary causes of the economic meltdown that dropped like a bombshell on baffled Americans. After all, weren't they basking in the most prosperous years of their lives? They were indulging in a soaring stock market, buying extraordinary houses, and going on fantasy vacations. Wasn't that the American Dream? What happened? The "American dream" is a phrase attributed to American author James Truslow Adams in his 1931 book, _The Epic of America_. He wrote: "It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position." In view of that, the modern interpretation has strayed far from the original meaning. In fact, the "American Dream" represents something more than the cars and big money that Adams warned about. Central planners and social engineers misappropriated the term, a long time ago, and put it into use as a slogan to convey a sense of entitlement and equality as they began to shape and subsidize the home ownership nation that started with the creation of Fannie Mae in 1938. A new book by Regnery author Thomas E. Woods, Jr., _Meltdown_, suggests that the American dream became an American bubble brought on by the reckless, self-serving actions of government institutions that commenced a series of interventions that culminated in a collapse of the stock market and financial institutions, along with the rapid disintegration of the US economy. Ergo, the American nightmare. Woods at once puts his finger on the unmistakable "elephant in the living room," the Federal Reserve System. As he points out, other than a few assorted rumblings, there has been almost no discussion in the mainstream media of the Federal Reserve's role in launching this crisis. The Federal Reserve, which centrally plans monetary policy and interest rates, sparked the crisis by drastically reducing interest rates beyond levels that would otherwise have been set by a free market. "Making cheap credit available for the asking does encourage excessive leverage, speculation, and indebtedness," Mr. Woods writes. He adds, "Manipulating interest rates and thereby misleading investors about real economic conditions does in fact misdirect capital into unsustainable lines of production and discombobulate the market." This begins the authors' explanation of the boom-bust phenomenon and how an artificial boom, and the financial holocaust it leaves behind, can be perfectly clarified and understood in terms of the Austrian theory of the business cycle. --Turn on the Bubble Machine-- Thanks to the Fed's easy-credit policies, the housing bubble became ground zero for the catastrophe. Mr. Woods points out severa

A Dose of Reality, and not a Moment Too Soon

Published by Thriftbooks.com User , 15 years ago

I looked forward to this book from the moment I received advanced notices about it. Thomas Woods does not disappoint. The chapters in this book are short and sweet. He lays out the Austrian Theory in terms even a bricklayer could understand. The solution is obvious, but politically incorrect, that the Fed via its money policy and paper currency, creates instability in the market. It is aided by Congress and their own libertine attitudes towards lending. The end result is the so-called business cycle, which results from the false promises of the government being bashed to bits by reality. This book is a godsend by clarifying what people have observed for years but couldn't piece together. It also helps to have someone of Mr. Woods' credentials as an historian and stalwart Catholic traditionalist hammer these point home. If it had been Murray Rothbard, Ron Paul, or Ludwig von Mises, or any of the Randians, the Paul Krugman's of the world would yell "Crank!" "Extremist!" or some other irrelevant charge, in order to distract us from the issue. Now after reading this book, which won't take you too long, you will know that this is not some curse from the gods but the deliberate result of government's incompetent operations. He does provide solutions that are immediate and effective. Restoration of commodity money, repeal of the legal tender laws, and above all else ABOLITION OF THE FEDERAL RESERVE. It does not take government sanctions to make money or to keep it's value. In fact the government has no business at all with money, outside of taxes. Thomas Woods demonstrates this on page after page, leaving no room for error or denial. This book should be read in conjunction with Hazlitt's "Economics in One Lesson" Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics for a one-two punch against the welfare-warfare state. We have now reached the point where we LITERALLY cannot afford the lunacy of liberals and conservatives alike. (I want you to go out and commit two treasonous acts: educate yourself, friends and family on economics, and enforce the Constitution on money, that Article 1, Sec. 8--no state shall accept anything other than gold or silver in payment of debt. )

Common Sense From an Uncommon Economist

Published by Thriftbooks.com User , 15 years ago

As the mainstream media pundits struggle through their shallow and predictable attempts to blame the free market for the economic collapse, Tom Woods rides in on a metaphorical white horse to put these myths in their final resting place. Their are innumerable reasons why everyone needs to read this book, but I'll mention just a few, in no particular order: 1. It gives a broad and deep overview of America's current economic situation, and who got us here. For example, Chapter 2 is organized as a series of short yet powerful jabs at whom Prof. Woods has identified as the "culprits" who caused the housing bubble, ranging from #1 - Fannie Mae and Freddie Mac, to #2 The Community Reinvestment Act, to #5, The Federal Reserve, and so on. 2. It is one of the most readable books on economics ever written. Cover to cover, this book takes maybe 4 hours to read and digest. 3. Prof. Woods fully utilizes his mastery of both economics and history to dispel myths about the Great Depression, the creation of the Federal Reserve, and the causes of economic panics prior to the existence of a central bank in America. 4. It explains what inflation is, and why it is bad. 5. It explains the absolute lunacy behind these massive bailouts being passed out to Fortune 500 companies like candy on Halloween. Throughout the book, Prof. Woods points out the serious flaws in the reasoning of various officials who supported these bailouts. For example, he writes: "According to [Henry] Paulson, "millions of Americans" were facing rising credit card rates or reduced access to credit, thus "making it more expensive for families to finance everyday purchases." That made even less sense than the usual Paulson rationalization. Think about it: is it sustainable in the long run for families to make everyday purchases on Credit? How can that go on?" 6. Perhaps most importantly, anyone who reads this book will have a whole arsenal of ideas to bring to the table when popular politics and current events are being discussed around the water cooler. After all, everyone wants to sound informed, right?

The Most Important Debate in our Lifetime

Published by Thriftbooks.com User , 15 years ago

Tom Woods has written a timely and timeless book - timely because it addresses the most pressing issue of our day, and timeless because he explains economic cycles and the nature of money in plain language. It is curious that Congress is on the verge of passing an economic stimulus bill that is opposed by nearly two thirds of Americans. Mr. Woods provides the logic behind the intuition of this increasingly disenfranchised majority. Americans opposed to further government meddling should read this book to fully arm themselves with the knowledge necessary to win the debate. Well-intentioned Americans who support government intervention in the economy should read this book to understand the unintended consequences of their support. Partisan readers beware: regardless of your political affiliation, you will discover that your party shares in the blame for the mess we're in. It is best to check your party affiliation at the door before you read this book. But read it! The first chapter quickly identifies fractional reserve central banking as the main driver of the current and previous economic downturns. It's a long-overdue call to debate the necessity of our Federal Reserve system. The second chapter addresses the housing bubble, and how the loudest voices on all sides of the debate are proposing solutions to the symptoms instead of recognizing the real problem. The third chapter addresses the government's futile reactions to the financial and economic crisis in the last months of 2008. It's amazing to see such recent history covered so well in a book. The fourth chapter alone is well worth the price of the book. Mr. Woods explains in plain language that economic cycles are not natural phenomenon, but are caused by artificial manipulation of the money supply. The business cycle theory of Ludwig von Mises and F. A. Hayek is explained in a manner easily understood by the layman reader. Chapter five covers myths of the Great Depression. Understanding this time in our history has never been so important as it appears we are on the verge of repeating the same mistakes. Mr. Woods gleans lessons by comparing previous market busts and subsequent government reactions to them. Again, the sixth chapter alone is worth the price of the book. Mr. Woods explains the nature of money. It's hard to believe how something we use every day can be such a mystery to us. It's impossible to effectively engage in the debate about fractional reserve central banking without understanding the nature of money. We learn in this chapter how money is a creation of the free market and not a government invention. The book ends with a chapter that instructs us on what courses of action (or inaction) that we should take in order to restore a lasting prosperity. It is vastly different than the choices being proposed by our government and the media. Whether you are a liberal, conservative, or something else, I implore you to read this concise, well-reason

Buy a second copy to throw at the TV

Published by Thriftbooks.com User , 15 years ago

In discussions of today's economic meltdown and what to do about it, the Federal Reserve is a stealth helicopter: it never shows up on the radar. With the exception of a few esoteric specialists and those Ron Paul Revolutionaries who burst into chants of "Abolish the Fed!" during campus rallies last year, it's like something has been put in our water to cause our eyes to glaze over and our minds to wander off at the very mention of centralized banking. Which is, of course, a Problem, since as historian Thomas Woods notes in this important book, the Federal Reserve bears a large part of the blame for the mess we're in. In the first part of "Meltdown," Woods shows how both in theory (the Austrian School, to be precise) and in practice, Fed policy fueled an artificial boom and instead of allowing the necessary, if unpleasant, short-term bust that will lead to recovery, is pursuing policies guaranteed to drive us deeper into the abyss. Little of this finds its way into the popular or business press, suggesting that the people who know the truth aren't talking, and the people who are talking either don't know or are deliberately trying to keep the helicopter hidden. As Woods writes, "critics of the market who ignore the arguments raised in this chapter are, to say the least, not being honest" (p. 86). But to paraphrase Will Rogers (no relation), it's not so much the things we don't know that are a problem, it's the things we DO know that aren't really true. That's why every bit as important as Woods' explanation of the role of the Federal Reserve in the unnecessary cycle of boom and bust is his taking down of decades' worth of myths about the government's role in the economy. As the author points out, historians have more or less abandoned the idea that New Deal intervention "got us out of the Depression," but the myth remains stronger than ever among journalists and the public. The result of this is not only a profound misunderstanding of American history, but more to the point, a widespread delusion that "history proves" massive government spending promoting consumer demand is the way out of a recession. Here again we see the apocalyptic power of bad ideas. All this suggests the economic crisis, and particularly the stimulus-driven response to it on the part of the Bush and Obama administrations, are a domestic equivalent of the Iraq War (I want to note that this is my metaphor, not Woods'): an over-reaction to a situation by and large of our own creation, and sold to the American people through a series of lies, the plan largely benefits those who argue for it most strongly while the rest of us end up poorer. The "opposition" is arguing over details while conceding the fundamental principle -- an intervention that gives the government a foothold of occupation it will probably never relinquish. That's why "Meltdown" is so important -- and why the Austrian School, which alone not only foresaw the coming crash but understood why it was going to ha