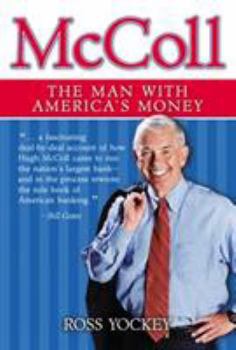

McColl: The Man with America's Money

A swashbuckling biography of Bank of America CEO Hugh McColl and the banking empire he created.

Format:Hardcover

Language:English

ISBN:1563525399

ISBN13:9781563525391

Release Date:September 1999

Publisher:Longstreet Press

Length:636 Pages

Weight:2.29 lbs.

Dimensions:1.5" x 6.3" x 9.3"

Customer Reviews

5 ratings

The South Rises Again

Published by Thriftbooks.com User , 24 years ago

A great book on a legend of American business. The book is entertaining and exciting due to the path taken to build one of the worlds largest financial institutions. Who would have thought this could have been accomplished by a bank in Charlotte, N.C. The drive and leadership from Hugh McColl makes him a true American legend.

A former colleague of McColl's comments on the book

Published by Thriftbooks.com User , 24 years ago

"McColl is a fascinating and inspiring book about the transformation of the Banking industry during the final one third of the 20th century, and the person who is credited more than any other with making that happen.Hugh McColl is portrayed as a man who is brilliant in intellect, a hard charging maverick who frequently steps on toes; knows his strengths and how to play to them; and is a master strategist and tactician when "in combat" (50 or so acquisitions to his credit). Healso is displayed as one who boldly and unguardedly speaks his mind wherever and with whomever he happens to be at any given moment. He can be brash, abrasive, even discourteous; but totally honest and without guile. And while he does not suffer fools or incompetents gladly, he is intense in his sense of loyalty, which he receives frequently and which he gives freely to those who earn it.McColl entered banking in the 1950's as the son of a banker from South Carolina's farming country. In those days it was common practice for small to mid-size banks in the southern US to pay customers 2% on their savings and charge them 6 to 8% for loans. All that was necessary to generate attractive earnings was to open their doors in the morning! As a result, qualifi cations for employment were minimal, usually requiring at most a high school education. Pay was low, demands were low, promotions were based on longevity when someone up the ladder died or retired. An employee was expected to "just stay out of the way, we'll call you if we ever need you", and thereby expect a job for life. As a result, when banking began to become complex and competitive, banks found themselves riddled with mediocrity at every level including that of CEO. It was considered unforgivable in that culture to bring outsiders into the bank at a level above the people with longevity. So those with ability and promise came and went rather quickly while the mediocritiestended to stay and rise to levels well beyond their capabilities.North Carolina National Bank (NCNB) realized their dilemma earlier than most and brought Addison Reese, a man of vision, wisdom, and experience from the out side as CEO; Reese in turn brought Tom Storrs, another outsider with high credentials to assist him. It is easy to imagine the distress of the people in the NCNB "family", whose reaction was resistance, both passive and overt.Despite the resistance, the mandate was sent strongly, clearly, and unequivocally that the culture was to experience a drastic change. Longevity would no longer be worshipped but would be replaced by excellence of performance. Prized characteristics would be related to intelligence, education, energy, vitality, visibility, innovativeness, courage to take risks, and competitiveness.These qualities fit Management Trainee Hugh McColl like a glove, and the stage was set for him to shine. He did, and the rest is history as deliciously set forth in this truly remarkable and m

Review From Business Week, November 15, 1999

Published by Thriftbooks.com User , 25 years ago

In the late 1950s, Hugh L. McColl Jr.'s father told him: ''Son, you don't have the brains to be a farmer. You'd better be a banker.'' Bad call. If Dad had hired Hugh Jr. to run the family farm, history might have been different--and the elder McColl might have wound up owning the next ConAgra Inc. Instead, McColl's desire to prove himself supplied the motivation to turn a sleepy Southern institution into the nation's first true coast-to-coast bank. Most impressive is that McColl built his megabank--NCNB-cum-NationsBank-cum-Bank of America--not from New York or San Francisco, but from Charlotte, N.C.In McColl, author Ross Yockey provides the most revealing profile yet of the banker who, even in the twilight of his career, remains an enigma. Given his brash style and penchant for invoking military imagery, McColl has been an easy foil for reporters, who have caricatured him as an ex-Marine who acquires banks with all the finesse of General Sherman. Implicit in this view is the notion that McColl can't possibly manage this sprawling empire.But Yockey paints a more textured, and more sympathetic, portrait. He shows McColl as a man who shrewdly anticipated the trends that would sweep banking in the 1990s--and who, a decade earlier, began positioning his institution for long-term survival. McColl's keen understanding of banking laws helped him find the loophole to enter key states such as Florida and Texas ahead of the competition--and thus win the critical mass needed to become the acquirer and not the acquired. What's more, McColl's early, massive investment in technology meant that many banks that had skimped on computers had no choice but to sell out to him.McColl's willingness to bare his soul to Yockey is all the more impressive, given his love-hate relationship with the national press. Granted, this is an authorized biography, and the author does pull a few punches: For example, there are few comments coming from McColl's early rivals to the throne inside the bank or from the many bankers whose institutions McColl acquired over the years.Yockey gives particularly short shrift to the controversies surrounding the merger between McColl's NationsBank and San Francisco's venerable Bank of America last year, as well as McColl's 1997 buyout of Montgomery Securities. The deals resulted in an exodus of virtually all of BofA's top executives and more than half of Montgomery's partners. And at 636 pages, the book plods--especially in its coverage of McColl's early years.Despite such shortcomings, Yockey manages to get inside McColl's head during episodes that range from crucial merger negotiations to the harrowing near-crash of NationsBank's corporate jet a few years back. Yockey also probes McColl's relationship with his father, as well as his passion for the Southern cause in the Civil War, which drove him to build a bank far surpassing those of his Yankee rivals in New York. McColl succeeded, and banking has never

This is no dull business book. Great adventure story-

Published by Thriftbooks.com User , 25 years ago

Who'd want to read a 600-page story about a banker? Hugh McColl is one banker we could all learn from. And since one out of three American families does business with McColl's great big bank, we stand to lose if we don't understand how he came to be "the man with America's money."This is no dull business book. From Page One, where you meet a man in his underwear contemplating the nature of power and loyalty, you start having trouble putting it down. It reads like a novel-even a movie script. It reminds you a little bit of "Barbarians at the Gate," only the barbarians are the good guys. I'm not sure what actor Hollywood could come up with to play Hugh McColl. Can Robert de Niro do a South Carolina accent?The story of McColl "stealing" Florida from Florida's old-line bankers, then riding into Texas like Santa Ana's army, is some of the best adventure writing this side of Tom Clancy. "McColl: The Man with America's Money" shreds whatever mental picture of a banker you might have. There are lessons in here on deal-making you won't find in a dozen textbooks and, just as importantly, there are lessons on how to hold onto your wallet when someone as tough as McColl rides into town to play "Let's Make a Deal."It's an "authorized biography," which means McColl agreed to talk with the author. But you wonder how Yockey ever got him to reveal some of what's in here, especially the parts where the crude, ruthless side of McColl's character comes through. If his lawyers and PR people had read it, the book probably never would have gone to press. Among the book's many detail-rich scenes is one in a little Georgia motel room, where McColl and Bill Clinton put together the deal for interstate banking regulations over a bucket of fried chicken while Hillary Clinton lies sleeping just a few feet away.Some of the people in San Francisco are still wringing their hands over how their dear old BankAmerica got gobbled up by McColl's NationsBank a year ago. By the end of this book, you find yourself wondering how any city would, should or could resist McColl and his determination to build stronger relationships in the cities where his bank does business. If there's a shortcoming to the book, its the longing for even more juicy details about this so-called "merger of equals," probably the last big deal of McColl's career and the one that made him CEO of the first coast-to-coast bank in America. It happened as the book was being written. Maybe Yockey is leaving those details for the sequel. In the meantime, read Part One - which, as Bill Gates says on the book's cover, is "a fascinating deal-by deal account of how Hugh McColl came to run the nation's largest bnak - and in the process rewrote the rule book of American banking."

Yockey reminds us that writing is ART! Brilliant!!

Published by Thriftbooks.com User , 25 years ago

Can an author make a seemingly dull topic, to the average reader, an involving saga? As Ross Yockey unfolds the life and triumph of Hugh McColl, CEO to Bank of America, the reader is taken captive to the poetic analogies and description. Not only is it a story of McColl's journey to the top, but of the development of the South as well. In true Yockey style, the Carolina's are portrayed appropriatley, without bias. McColl is not made out to be a hero or a villian, but his power is evident. Ross Yockey is sitting on another award winning best-seller!