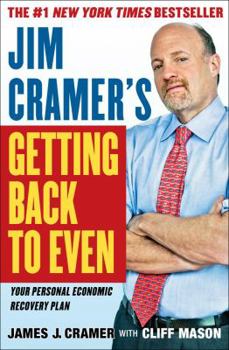

Jim Cramer's Getting Back to Even

Select Format

Select Condition

Book Overview

You Might Also Enjoy

Customer Reviews

Rated 5 starsGood book

I learned a lot of information that I will use. I wish he had used more charts but he explained things in a very understandable way. I bought it mainly for the 2 options chapters. That alone was worth the price of the book.

0Report

Rated 5 starsGreat book for beginners

I admit I love his show but the real reason I give this book 5 stars is for the Options chapter. Every option site I have viewed made it seem so complicated, which it can be, but buying call options is as easy as it gets and for me so far very profitable.

0Report

Rated 5 starsCramer shows investors how to get their portfolio back to even

I would buy this book regardless of what your personal opinion is of Jim Cramer. My investing and stock trading style is very different from his but I agree with him on most points in this book. In this book Cramer focuses on many risk adjusted strategies that over time will bring your portfolios back to even, if you are down the 30-50% like most investors are in the past two years. (I am a trend follower and did my homework...

0Report

Rated 5 starsGood book

I really like the book. Thanks Jim Cramer for the investment insight again. 1. One thing what Jim talks about is how the mutual fund play in the stock market. 2. This is important you need to buy stocks when the market is in a uptrend and a stock which is hitting the 52 weeks high is going to go higher. 3. Also investment is about gaining knowledge. 4. One other important lesson in investment is how and when to sell your...

0Report

Rated 5 starsFinancial First-Aid - Cramer Style

First a caveat, Jim Cramer seriously annoys me. I rarely ever watch his show (especially after the notorious "melt-down") and less frequently read his books. However, as a college instructor and business writer, I read a lot of business books and make a point of keeping up with what is in the popular press since it tends to come up in daily questions etc...admittedly, I was also curious how well a book claiming to help people...

0Report