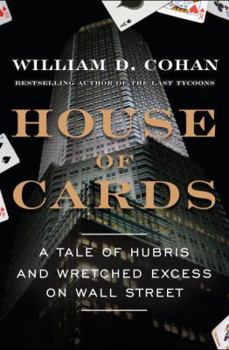

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Select Format

Select Condition

Book Overview

A blistering narrative account of the negligence and greed that pushed all of Wall Street into chaos and the country into a financial crisis. At the beginning of March 2008, the monetary fabric of... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0385528264

ISBN13:9780385528269

Release Date:March 2009

Publisher:Doubleday Books

Length:468 Pages

Weight:1.76 lbs.

Dimensions:1.2" x 6.5" x 9.2"

Customer Reviews

5 ratings

A better book than some of the critical reviews suggest

Published by Thriftbooks.com User , 15 years ago

With 58 reviews already, I don't have much to add in terms of description. I'm writing this because I found the reviews I agree with most are too critical. Yes the level of technical detail is uneven, and there are some editing errors. The subtitle is deliberately misleading to fool readers and pander to stereotypes. Yes, House of Cards is only about half the story. No, it is not as polished or satisfying as When Genius Failed or as juicy as Den of Thieves. But this book came out as events were still unfolding, unlike the others, and tells a much longer and more complicated story. Given the constraints, it does a fine job of covering the history of Bear Stearns, the personalities and motivations of the key actors in its final days and the financial forces at play. Unlike most accounts, it's reasonably fair and balanced. I think it's the first really good book-length description of some of the events that are shaping the future, but nobody understands. If you can afford to wait four or five years, someone will probably come up with a better account of the end of Bear Stearns. But by that time it will likely be a minor financial footnote. So read this book now if you want to understand more about the Wall Street of 2006 and the transformations that have taken place since then. Oh, and avoid Street Fighters if you're choosing between these two.

And they are still walking the streets?

Published by Thriftbooks.com User , 15 years ago

I found this book to be an easy read and appalling at the same time. The unscrupulous nature of some (underscore SOME) of the men who ran the show at Bear Stearns is shocking. Talk about a lack of a moral compass! And reading the words that two of the most flagrant abusers while under investigation are not currently being prosecuted is mind-blowing. If you want to have an inside look, please take the time to read and ponder this book. I am very glad I did!

Most Enlightening book On the Crisis so Far

Published by Thriftbooks.com User , 15 years ago

This book concentrates on the fall of Bear Stearns which was the first major financial institution to crash here in the USA. The book is casually written and does map out how quickley liquidity crisis can wipe out a leveraged firm by stepping you through the day to day happenings of the last 10 days of the firm's life. Wall Street firms are much different than other firms such as auto or computer firms. If you havent read much about Wall Street and havent understood this then this book is a good introduction to some of this. I have some sense of this as I have a brother who has worked on Wall Street for 20 years, but this book still gives a sense of what was going on in this particular crisis. Banking and especially investment banking is a highly leveraged business by definition and so the dynamics of these businesses are fundamentally different and you can get a good sense of this from this book. After walking the reader through the last 10 days of the crisis the book then goes back and takes a much broader view filling in the context by giving the history of the Bear Stearns company and then giving very detailed background information on the key longtime leaders of Bear Stearns. It is clear that Bear Stearns was a bit of a rogue shop lead by a pretty independent minded group of traders who had been at the firm in some cases for 40-50 years. In giving the history of these leaders and also filling in their expertises one can see some of the strengths and weaknesses of the firm and of the leadership in place. There is enough history in place here that you can understand how this company came to be such a stalwart of the fixed income arena as they had some of their big wins in bond markets and that is what the leadership understood best. It does appear that they had a guy running a couple of their hedgefunds who while a smart guy was not a very skilled manager and they appear to have let this guy get over his head. His manager was protecting him from interference from the "compliance" officers of the company. It also appears that this manager of the two hedge funds was engaged in fraud to the extent that he clearly saw that the mortgage derivatives from the subprime market were riskier, he was much more dependent upon these securities than he was reporting to the investors. This guy is apparrently in the courts on a couple of charges. Bear Stearns was clearly filled with some interesting characters and there are enough anecdotes from the discussions to give you a pretty good feeling for the types of salty guys they were. There are also the reports on the lifestyle that some of these guys were living and of course it is clear that those at the top had some pretty interesting lifestyles. Some of these guys had like 5 houses and couple Ferrari's. The Ceo who was forced out just shortly before the company crashed had a summer routine where he would be helicoptered in the late afternoon on Thursdays to the golf course in new jersey for a qu

Way juicier but sort of like watching dominoes fall

Published by Thriftbooks.com User , 15 years ago

Cohan details the bursting of the bubble in a book that reads like part gossip columnist, part financial thriller. Talk about making your average Jane feel smart, Cohan makes the big names of Wall Street look like a bunch of rats scurrying about thinking they have won the cheese when really they are about to get the big, gut-popping smack-down. I enjoyed this read because, aside from being mildly fascinated by economics, it does seem to answer the question that most American are now asking as they look at their 401Ks, retirement plan statements, and now-empty stock portfolios: "What the hell were they thinking?" Calling it a 'House of Cards' is quite apt as Cohan shows us how multi-million, er, make it billion, dollar empires were built on quicksand: stuff backed by things backed by more stuff, sorta. This is some seriously fascinating stuff- many of the chapters read like a financial drama cum thriller. Cohan puts the reader in the middle of the action: the "Wehrmacht" SWAT team of Bank of America 'parachuting into the downtown offices of Sullivan & Cromwell' to review Lehman's books, an edge-of-your-seat account of the weekend that the Fed, specifically, Geithner and Paulson- try to anticipate the consequences of the scenarios (which includes some pretty candid quotes right from the source), you can almost hear the jaws drop as Wall Street is informed there will have to be a "private sector solution" i.e. no bailout for Lehman Bros., the scramble to broker a deal with Barclays to take on the bulk of Lehman, the refusal of the FSA(the UK's version of the SEC who needed to okay the deal) to accept the deal, the back-room conversations exuding palpable fear as CEOs from some of the largest firms considered who might be the next to fall, the thirteenth hour desperation of Lehman execs trying to make a case for a federal bailout, and finally the reality of bankruptcy and no calvary riding in... and, of course, Lehman's was sold to Barclays under the supervision of the bankruptcy court. While Cohan's book is both entertaining and enlightening, the real value I see here is he does a pretty good job of shoowing us how we got here... why this bubble was different from the others. It's all well and good to say that hindsight is 20/20 but ultimately we're all living with the consequences of the decisions made by a very elite few. I got through this in one day- the writing is excellent. Very straightforward with the facts without waving around the blame stick too much- it's there in the title, though. Definately, if you are going to read even one book about how we arrived at this financial crisis- this would be a great choice.

Well Told Story of Serious Financial Mismanagement

Published by Thriftbooks.com User , 15 years ago

"House of Cards" reports on the collapse of the investment banking house Bear Stearns (America's fifth-largest investment bank), and the beginning of the worst banking crisis since the Great Depression. Cohan's background as an investment banker allows him to cut through the complexity to explain what happened in simple, clear terms. Bear Stearns had survived every crisis of the 20th century, including the Great Depression - without a single losing quarter - until the end of 2007. In 1997, Bear Stearns had helped pioneer the subprime mortgage-backed security by serving as co-underwriter on a $385 million offering. By the mid-2000s, it was the market leader in this segment. The focus of the book is the last ten days of Bear Stearns, leading up to its absorption by J.P. Morgan at a fire-sale price ($10/share, down from $167; less than the value of its $1.5 billion office building), greased by $30 billion in Federal Reserve funds. (The Fed was worried that a bankruptcy of Bear Stearns could wreak fiscal havoc around the world.) Just a year earlier it had been identified as "America's most admired securities firm" by Fortune magazine; in 2006 its Asset Management fees had reached $335 million. Bonuses were in the 8-figure range. Unfortunately, it was also the most heavily invested in mortgage-backed securities. Bear Stearns, like its competitors, financed itself with oversight sources (the cheapest source). However, when analysts began questioning Bear's viability, given its shaky mix of assets, continued financing for Bear dried up, and it toppled. Amazingly, its chairman was too buy playing bridge and golf to get involved until too late; earlier he had forced out the only many who understood what was going on. The firm even turned down a last-minute offer from a Saudi Arabian for substantial financing ("not needed"). Its leadership then blamed the media and short-sellers for Bear's demise. True, Bear's fall was quite rapid. However, there had been warning signs - problems at smaller firms with similar asset structures, rising risk premiums for its mortgage bond holdings ($50,000 for $10 million during the first half of 2007, rising to $350,000 on 3/5/08), its first quarterly loss at the end of 2008, and the downgrading of some of its bond holdings. Worse yet, Cohan also alluded to failing to conserve cash by reducing dividends and ceasing stock buybacks, as well as increasing leverage - unfortunately, it is not clear whether he was referring to Lehman, Bear, or both. The bad news - the 468 pages, complete with endless interviews and accounts of bridge games, is a bit much. The even worse news - Bear Stearns' and others playing for billions has left American taxpayers with a debt of trillions. And we still haven't heard "the rest of the story."