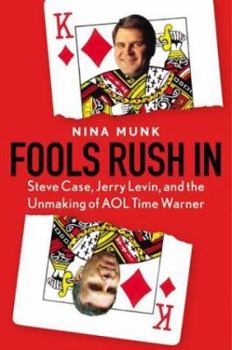

Fools Rush in: Steve Case, Jerry Levin, and the Unmaking of AOL Time Warner

Select Format

Select Condition

Book Overview

On Monday, January 10, 2000, America Online announced that it was buying Time Warner for $163 billion. The news was crazy, incredible. The biggest merger ever, it was, according to the media, an "awesome megadeal" and "a fusion of guts and glory." It was "the deal of the century" and "a mega-marriage of earth and cyberspace." An Internet upstart, AOL was buying the world's most powerful media and entertainment company. "A company that isn't old enough...

Format:Hardcover

Language:English

ISBN:0060540346

ISBN13:9780060540340

Release Date:January 2004

Publisher:Harper Business

Length:368 Pages

Weight:1.45 lbs.

Dimensions:1.2" x 6.0" x 9.0"

Customer Reviews

5 ratings

How to turn $200-billion into a "mess of porridge"

Published by Thriftbooks.com User , 20 years ago

This is an infectious read. The book itself is beautifully presented and Nina Munk writes like an angel. Well, if you're not Jerry Levin, et al., she does. She has a knack for making the words flow and the personalities as vivid as the sights of childhood. Her hard-edged but clean and crisp style will be widely imitated I predict. Her ability to research and to sift through the results of that research and to lay it all out in such an intriguing way is something close to amazing. I really don't give two hoots about Steve Case, Jerry Levin, the old Luce culture ("I am biased in favor of God, Eisenhower and the stockholders," p. 7), the Warner Bros. legacy (sleazy ethics and "foul tongues" and rumored "Mafia connections," p. 35), the dot com upstarts ("You people really need to start moving at Internet speed," p. 231), etc., but Munk makes it fascinating, like egomaniacs twisting in the wind, so to speak.But this story isn't just about AOL Time Warner but about corporate America in general, about how merger mania and golden parachuted moguls can play fast and loose with our money, our livelihood, our country, and our future. It's about the collateral damage, the megalomania, the broken hearts and the evaporated portfolios. It's about the mentality of corporate CEOs like Levin who as he turned sixty wanted to be remembered for something other than the bottom line, "for integrity...high moral principles; and wisdom." (p. 133) Ah, yes, a lifetime of chasing money and power and now True Religion. One is reminded of Bill Gates with the very demanding problem of how to distribute all that money wisely before he dies. Munk knows these people. How she got them to be so carelessly candid at times amazes me, especially her work with Levin. She understands their psychology and to some significant extent, their business. She had to, to write this book and make it work. She packs the text with spiffy and sometimes all too revealing quotes. She has the heart of a baggy-eyed scholar and the soul of a muckraker. The almost surrealistic give and take between Case and Levin as they cooked The Deal reads like something out of a Hollywood movie. Whose ego, whose sense of personal power, and imagined historical accomplishment and brilliance needed massaging the most by whom? And who would steal more from the other? And the ease with which Salomon Smith Barney and Morgan Stanley each got $60-million for their part in the deal reads like tales of manna falling from heaven.There are some black and white photos in the middle of the book. The test is exquisitely edited and proofed, and the book handsomely designed. Munk ends this "morality play," as she calls it, with a curtain call of the cast of characters in an epilogue and brings us up to date on what has happened to them and what they're doing now.Incidentally, my subject-line quote about a "mess of porridge" is from Robert Murdoch, no doubt licking his chops. (p. 280)Bottom line: you will be kept

Great reporting of an important business and cultural story

Published by Thriftbooks.com User , 20 years ago

Nina Munk has done us a very fine service in reporting this important story. The strange time we went through that allowed people like Jerry Levin, Steve Case, and others to become oulandishly compensated and nearly all-powerful executives should be a cautionary tale for generations to come. It is just weird to read how these folks worked, what they thought and believed, and how they try and justify it today.The book is a lively read. It is not a business book laden with numbers (which I would probably have enjoyed even more - but that's me). Instead, it is a story of personalities with just enough numbers to orient the reader to the fantasy world these executives fled to. In fact, this really couldn't have been a story told with hard numbers - because there really wasn't very much solid at the core of these valuations.Ms Munk does a fine job of reporting what those involved thought and did. She did a lot of first hand interviewing to get some of the best information. She also provides good notes and sources for what she reports in the book. This isn't a simple rehash of news stories, although the outlines of the story will be familiar to anyone who did follow these events in the news.Personally, I found the destruction of the Time magazine morgue as a cost cutting move both horrifying and a perfect example of the cultural blindness that afflicts far to many of those who justify any behavior if they can use it to raise the stock price. We have to demand that they attend to something more than price manipulation in their running of these great publicly held institutions. Not through government regulation, but as shareholders, we need to make sure that these folks realize it is not okay to burn down a library full of priceless information to save a fraction of a cent per share of cost.Thanks to Nina Munk!

Human drama about how the mighty have fallen

Published by Thriftbooks.com User , 20 years ago

Great book about the fiasco at AOL Time Warner. I don't always like business books, so I was glad to find that this one had strong narrative. It's really about power and how it can be abused. Case and Levin were both guilty of monumental hubris. Author Munk studies their characters like a novelist, without passing judgement, but rather showing how their not-so-well-thought-out plans backfired when they encountered reality.

Brace yourself for one long night of page-turning

Published by Thriftbooks.com User , 20 years ago

WOW- what a book. I'm not in business, but stumbled across this book and ended up reading it from cover to cover in one sitting. It really reads like a Greek tragedy; each character enters the story with certain fatal flaws and the end of the story is almost pre-destined. Hard to believe that it's non-fiction. There is a remarkable amount of research in this book- the author went to great lengths to interview what seems like hundreds of sources. Given that the AOL story is so "of" the late '90's, I think that this eloquent book will mark the time, much like Bright Lights, Big City marks the '80's. This book's going to be required reading form business students for years to come.

Novel business - Business novel

Published by Thriftbooks.com User , 20 years ago

This was the biggest of them all. In the madness for tech stocks where millions rushed in to make a fast buck, as is the case with all such crazy manias starting with the legendary tulips , billions of dollars were generated out of thin air, virtually, and in the most recent decade , perhaps digitally. Suddenly, reality strikes, gravity starts acting and the rest is history. Sadly, history repeats itself.This book is the story of AOL using virtual money to buy real assets. If the real story is interesting, Nina Munk has made it exciting. Grass on the other side is greener, the old saying goes. AOL wanted something real to latch on in its digital world while Time Warner was craving for digitization. A merger, would be a perfect marriage, as it appeared to the CEOs of the two companies. Three years since then, over $ 200 billion of stock valuations have evaporated back into where they belong - cyberspace. It is said that greed, optimism and herd mentality are the three drivers of capitalism . Need a better example ?A repetition of these obvious facts is not what makes this book a good read. Nina Munk has diligently tracked the business histories of the companies involved, listed the key players and their biographies and then integrated this background into the main story of the merger and its problems.Easy to read, and light on technical aspects. At the end, I personally feel that Time Warner in its new form has the capacity to come back. After all it is this true spirit of free enterprise that keeps America going. When the going gets tough, the tough get going.