More by Paul C. Nagel

Book Overview

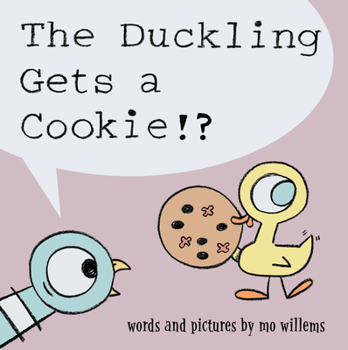

Mo Willems, #1 New York Times best-selling creator and three-time Caldecott Honoree, presents a sweet Pigeon adventure.

The Duckling asks for a cookie--and gets one It isn't fair The Pigeon NEVER gets what he asks for. Do YOU think the Pigeon should get a cookie, too? Say "no " to all the Pigeon books

Don't Let the Pigeon Drive the Bus Don't Let the Pigeon Stay Up Late The Pigeon Wants a Puppy The Duckling Gets a Cookie ?The Pigeon HAS to Go to School The Pigeon Will Ride the Rollercoaster Don't Let the Pigeon Drive the Sleigh

For Mo' amazing books, check out these other great series:

Knuffle BunnyElephant & PiggieUnlimited Squirrels

The Duckling asks for a cookie--and gets one It isn't fair The Pigeon NEVER gets what he asks for. Do YOU think the Pigeon should get a cookie, too? Say "no " to all the Pigeon books

Don't Let the Pigeon Drive the Bus Don't Let the Pigeon Stay Up Late The Pigeon Wants a Puppy The Duckling Gets a Cookie ?The Pigeon HAS to Go to School The Pigeon Will Ride the Rollercoaster Don't Let the Pigeon Drive the Sleigh

For Mo' amazing books, check out these other great series:

Knuffle BunnyElephant & PiggieUnlimited Squirrels

Format:Hardcover

Language:English

ISBN:0812930959

ISBN13:9780812930955

Release Date:May 2000

Publisher:Crown Business

Length:352 Pages

Weight:1.46 lbs.

Dimensions:1.2" x 6.5" x 9.6"

You Might Also Enjoy

Customer Reviews

5 customer ratings | 5 reviews

There are currently no reviews. Be the first to review this work.