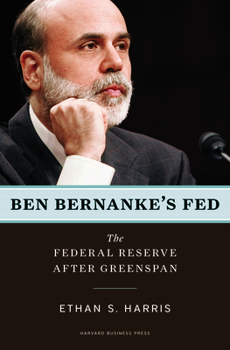

Ben Bernanke's Fed: The Federal Reserve After Greenspan

Ben Bernanke's swearing in as Federal Reserve chairman in 2006 marked the end of Alan Greenspan's long, legendary career. To date, the new chair has garnered mixed reviews. Business economists see him as the best-qualified successor to Greenspan, while many traders and investors worry that he's too academic for the job. Meanwhile, many ordinary Americans do not even know who he is. How will Bernanke's leadership affect the Fed's actions in...

Format:Hardcover

Language:English

ISBN:142212584X

ISBN13:9781422125847

Release Date:July 2008

Publisher:Harvard Business Review Press

Length:237 Pages

Weight:1.20 lbs.

Dimensions:1.0" x 6.3" x 9.1"

Customer Reviews

5 ratings

Great read on Bernanke and the role of the Fed

Published by Thriftbooks.com User , 15 years ago

I thought this was one of the best books I have read on the Federal Reserve. While obviously it talks a lot about Bernanke's history and his ideology. What I found even more interesting was its discussion on how the Fed affects our economy. It does so in terms that anyone can understand and does not get into any complicated jargon. I would highly recommend this book if you are interested in not only Bernanke's history and how he is different from Greenspan but also if you are just interested in how the Fed works.

A look into the Fed's and Bernanke's challenges

Published by Thriftbooks.com User , 15 years ago

Ethan Harris' book on Ben Bernanke's Fed after Greenspan is an interesting look at two different men. Each possessing their own individual strengths and weaknesses. This is a fascinating look at better understanding the past and the present of the Federal Reserve. My fear, at first reading, was that of wading into the minefield of William Greider's "dry and cautious language of economics, technical talk that is not very quotable". What I discovered was something quite enjoyable as Harris covers Alan Greenspan's enviable record of guiding the economy and the markets with his share of errors and successes. He then unfolds Bernanke's agenda of "inflation targeting, plain speaking, a more democratic committee, more reliance on models and research and a lower profile for the chairman". Harris debunks the populist tradition of believing the Fed to be part of the conspiracy of the bankers and the rich to control the workers and small businesses. He also takes on demystifying the Fed by opening it's doors and explaining how the Fed manages the economy. This is a good read that doesn't require an advance understanding of macroeconomics. As an economist for Lehman Brothers, Harris is not without adding his economic opinions as well as asking questions about the future of the Federal Reserve. Well worth the read and addition to the business shelf.

A Readable, Insightful Book on The Federal Reserve

Published by Thriftbooks.com User , 15 years ago

Ethan Harris has provided a very well written, very readable monograph on Ben Bernanke and the Federal Reserve Bank. He does a wonderful job of explaining broad macroeconomic theories in an understandable prose that anyone can grasp. This book goes into some detail on the how the Federal Reserve system works and how the central bank's policies impact the economy. The main theme of the book, however, is how Ben Bernanke's chairmanship is likely to differ from, and possibly be an improvement over, the tenure of Alan Greenspan. It offers some hope that Bernanke is cut out for his important role in tough economic times, despite some critics of early in his tenure. Bernanke comes from an academic background, and while that sounds like a positive, his lack of experience in the fast moving world of business and economic forecasting could initially have put him at a disadvantage. But his digging into this new role as a longtime member of the Federal Open Market Committee (FOMC), with the more tempered approach of an academic, offers a different style than Greenspan. Beyond describing how the Federal Reserve system works, which makes the book worth reading in and of itself, there are several themes about how the Fed will be different under Bernanke. First, Greenspan was a "rock star" or "celebrity" economist with a very high public profile. Bernanke is quite different, with a lower profile and will likely be more tempered in his dealings with the press and public. Second, the decision making process of the Federal Reserve is more transparent and open, instead of secretive and opaque. This should lead to the financial services industry having a better understanding of why the Fed makes the decisions it does and where it's likely to go next. Third, the decision-making process is more consensual than autocratic. Greenspan dominated FOMC and could often use intimidation and his stature publically to get his way. While the more collegial process may sometimes highlight disagreements, the approach is also more democratic and transparent. Fourth, related to transparency, is that Bernanke's Fed is much clearer about what their policies are likely to be in the future and why, unlike Greenspan who talked and communicated in such arcane language that firms actually hired consultants simply to puzzle out what Greenspan meant and what the Fed was likely to do. While this candor and transparency may open up the Fed to more criticism, it's a more forthright and reasonable approach than secrecy. Finally, Bernanke is not likely to overstep his bounds and consult on broader economic issues outside the Fed's purview. Greenspan's inserting himself into economic policies either by speaking to the press, or as an advisor to politicians, was seen by some as possibly threatening the independence of the Fed from politicians. There is much more in the book, including specifics on different policy approaches and styles. This is a book well worth reading to

Ben

Published by Thriftbooks.com User , 15 years ago

Ben Bernanke's Fed inherited bubbles--housing and credit. He is a student of the Great Depression and Japan's lost decade, the 1990's. The Great Depression spawned Keynesian economics and the 1970's inflation led to the return of classical economics. The Phillips Curve is the relationship between unemployment and inflation. The levers at the disposal of the Fed are the federal funds rate and the discount rate. Bernanke is an advocate of the financial accelerator effect. The Fed is independent of political pressure, at least up to a point, through the long terms of its members and it is self-financing. Alan Greenspan used constructive ambiguity in his communications. Bernanke has explained that embiguity, in the belief of the central bankers, made policy more effective. Alan Greenspan helped to rescue markets in 1987 and 1998 and was a favorite of investors. Greenspan fought inflation from a passive stance. This avoided imposing pain on the economy. Recession under Greenspan only took place during eight percent of his tenure. A controversial time was Greenspan's support of the Bush tax cut in 2001. (There was confusion over the tax advice.) Whereas Greenspan believed in monetary discretion, Bernanke prefers inflation targeting. Bernanke uses a committeee approach to decision making. He doesn't support pre-emptive strikes against asset bubbles. There is the problem that bubbles are hard to identify, policy responses may be poorly timed, and it is hard to pop the bubble. In normal times Bernanke favors a gradualist approach. In times of stress he supports aggressive risk-management. In 2008 the Fed had unprecedented rate cuts to deal with the crisis. Most economists were surprised by the scope of the crisis in capital markets. Well, the book is informative. The general reader, (I include myself), is in a position to receive guidance to sift through our current economic dilemma. The story isn't over, but understanding has been increased.

Ben Bernake's Fed. Ethan Harris. Harvard Business Press.

Published by Thriftbooks.com User , 16 years ago

Harris has written a book which is scholarly yet highly entertaining. A crystal clear, in depth ,and accurate explanation of the Federal Reserve and its Chairman.Also included are numerous short anecdotes and clever comments from Fed history.