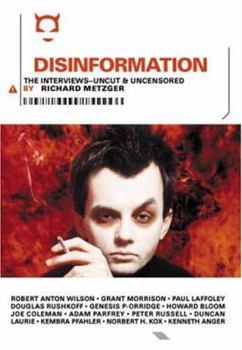

Disinformation: The Interviews.

The best and most revealing interviews from the prococative TV series/DVD of the same name.

Richard Metzger presents the most compelling interviews from the hit TV series Disinformation, revealing mindblowing thoughts from modern culture's most radical thinkers:

Paul Laffoley on how to build a working time machine and a house made of vegetablesDouglas Rushkoff explains media virusesLucifer Principle author Howard Bloom on the coming biological apocalypseGenesis POrridge on what it's like to be the leader of your own cultJoe Coleman's collection of weird stuffRobert Anton Wilson on The Illuminati and Aleister CrowleyKembra Pfahler on The Voluptuous Horror of Karen BlackDuncan Laurie on the forbidden science of radionicsComic book author Grant Morrison (The Invisibles, JLA, XMen) on sex magickHollywood's interest in underground culture and the best alien abduction story you'll ever hear

Plus, many more modern revolutionaries (including philosopher Peter Russell, futurist Mark Pesce, and Apocalypse Culture's Adam Parfrey) expressing their thoughts, fears, enthusiasms, and predictions.

Customer Reviews

Rated 5 starsA happy accident

I first picked up this book out of curiousity when it was among the "Staff Picks" at Forbidden Planet book shop in NYC.Challenging interviewing that gets to the core can only come from a writer who chooses to be interested as well as interesting.I always like when work like this is smart but not detached. By the very exploration of such arcania, there is no detachment and Metzger doesn't pretend there isn't. So many books...

0Report

Rated 5 starsA volatile subcultural primer

This book is comprised of selections from nearly a dozen important interviews conducted for the Disinformation television series, which unfortunately most Americans have never been allowed the opportunity to see. That may change soon with the release of the Disinformation DVD, but in the meantime this book gives you an excellent overview of the varied thinkers, artists, and pop-cultural agents provocateurs whom Richard Metzger...

0Report

Rated 5 starsVisionary Artists and Brilliant Ideas

Another wonderful book from the disinfo crew. Unlike the past volumes, this one includes brilliant color reproductions of some truly mindblowing art. Richard Metzger has had the courage to challenge the system over the years, and has somehow managed to get some pretty insane stuff out over the airwaves. This book documents some of his finer moments, and it is great to see some of these groundbreaking artists get the attention...

0Report

Rated 4 starsA PRIMER FOR THINKING

Usually I wouldn't review a book that included myself. But the groundlessly destructive review by John Conroy necessitates ensuring that potential readers of this book be informed of why it is ESSENTIAL reading. The primary criticism I can isolate by JC is that the 12 people interviewed herein are not 21st Century. In fact, familiar as I am with many of the concepts, strategies and commentaries discussed with incredible honesty...

0Report

Rated 5 starsThe Most Interesting People You've Never Heard Of

Alright, well maybe some people have heard of the people interviewed in this book - Howard Bloom or Robert Anton WIlson perhaps - but how many really know much about radionics expert Duncan Laurie or artist-futurist Paul Laffoley?Certainly not the previous reviewer, because if he'd actually read the book he'd know that the disinfo.com website is run out of New York, Metzger is based in LA and he's never appeared at the Prophets...

0Report

![A History of the Islamic World [ILLUSTRATED]](https://i.thriftbooks.com/api/imagehandler/s/BB9B3D5D0455DFED1E65B93D14C2AB25D822D353.jpeg)