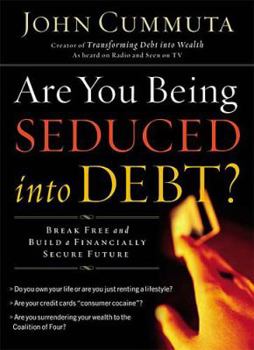

Are You Being Seduced Into Debt?: Break Free and Build a Financially Secure Future

Studies have shown that 96 percent of Americans fail to achieve financial independence by the age of 65. Cummuta helps readers stop succumbing to the seduction of debt and take charge of their own financial future.

Format:Hardcover

Language:English

ISBN:0785263306

ISBN13:9780785263302

Release Date:January 2004

Publisher:Thomas Nelson

Length:304 Pages

Weight:1.15 lbs.

Dimensions:1.1" x 6.4" x 9.2"

Customer Reviews

4 ratings

I'm eager to review the notes I took on John's course

Published by Thriftbooks.com User , 19 years ago

I almost didn't consider a review, but in my online research for info about Mr. John Cummuta, I found this link and recalled I could submit a review -and felt the obligation; I ordered the course he offers, so I am guessing that the book here is in the course -or is very similar to it, so my review of his course will give you an idea of how the book is. (I did online research to see what was up with his course and if I should return it & get my money back or keep it.) Anyhow, some "oldie but goodie" ideas include the simple but reliable adage to NOT be in debt. Mr. Cummuta tells the reader (or listener in my case; I had CD's) early on that you gotta cut up that credit card. He makes his case well, and as a person who has used credit cards successfully for many years, in college and since, I say from experience: He is right. Most of the time, I had not problems with using my credit card, but recently some emergencies have pushed my balance up to about 5,000 dollars, and let me tell you: The interest of about $50.oo per month is eating me up because (as I'm sure you know) you don't pay on the principal owed until AFTER you've paid that interest. Suffice it to say that he is right. After he makes his case, he casually mentions another wise man, Solomon, the author of Proverbs, whose proverbs caution the reader to NOT be in debt. (Yes, I was surprised to here him quote the Bible, even as a person who believes in it, but he is right, and he is careful to acknowledge that some people might have different religious beliefs. He is careful to not offend the reader, but merely offer this as supplemental info for the curious; He does well here!) The elimination of credit card debt is not the only thing he has to offer, but there were new things in his packet (which may or may not be in this particular book; I don't know). He lists four (4) different ways to supplement your income, and is careful to admit that these are NOT "get rich quick" methods. The four he lists are: #1, An intro to e-bay and online auctions; #2, buying & renting residential real estate (the "landlord" thing); #3, Creating & marketing information products; and, #4, Online affiliate marketing business (that is, click-able referrers on your website). Those were a refreshing addition which stimulated my imagination, but the **main** focus he makes is to pay off your debts in a "logical" fashion, prioritizing the "most important" debt first. He shows the reader how you divide the balance by the minimum payment that the creditor sets, and you get this figure for each debt, that tells you which one is a priority. I think that the smaller the balance in comparison to the payment, the easier it is to pay off, and should be prioritized, with the other debts receiving the "minimum monthly" payment. This is "logical" because the "spare cash" you'd have after that debt is paid can go to the other debts. He also has a laundry list of tips to cut corners, and some of them are good, li

Your Future Wealth Depends on it!

Published by Thriftbooks.com User , 20 years ago

This book is a must read for every person, no matter where you fall on the income scale! It's easy to read and understand. It not only tells you the problem but, guides you through the solution. People are in for a rude awakening , if they don't begin to understand these dangers and start doing something about it right now! Bravo for John Cummuta for bringing us the answers and guiding us down the road to a brighter future. You've given hope that we can get out of the mess we've gotten ourselves into with debt. And you've done it an entertaining way. Thanks!

Easy Read - Good Advice

Published by Thriftbooks.com User , 20 years ago

I don't think the first comments made on this sight are very fair to the author of this book. If this was such basic information that anyone should know then why are so many people in such terrible debt?! This book makes the idea of getting in too deep easy to understandand and the way out easy also. So many people really need these simple examples to help them out of trouble. As a teacher I am happy to see someone who is willing to talk to all people and not only to those who already understand the world of finance.

My employees love it

Published by Thriftbooks.com User , 20 years ago

I am constantly looking for ways to help my employees have a better life. We employ more than 350 great people around the state of Wisonsin. The majority of these people live from paycheck to paycheck. I get many requests for financial help and I hear sad stories from many of my co-workers about the debt lifestyle they live. I have given hundreds of small loans to my employees over the years. After reading " Are You Being Seduced into Debt", I realized that some of our workers were never going to be able to escape their current financial mess until they understood how debt can ruin their lives. John Cummuta has changed my outlook on debt through this book. I have made it required reading for anyone who comes to me for financial help. Donald B Knapp