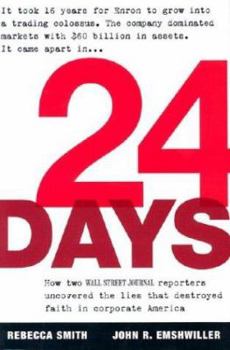

24 Days: How Two Wall Street Journal Reporters Uncovered the Lies That Destroyed Faith in Corporate America

Select Format

Select Condition

Book Overview

This is the story of Rebecca Smith and John R. Emshwiller, the two reporters who led the Wall Street Journal's reporting on Enron and uncovered the unorthodox partnerships at the heart of the scandal... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0060520736

ISBN13:9780060520731

Release Date:August 2003

Publisher:Harper Business

Length:400 Pages

Weight:1.60 lbs.

Dimensions:1.3" x 6.0" x 9.0"

Customer Reviews

5 ratings

Great Book for Enron "Junkies" and Others

Published by Thriftbooks.com User , 19 years ago

24 Days is a great exposé from the reporter's point of view. The time period was hectic: 9-11 had just happened and then Enron falls apart. Many who had worked at the company (non-executives) thought Enron was the "Rock of Gibraltar" and Smith and Emshwiller do a great job of capturing the elusiveness of the executives and those who had the responsibility of communicating with the public (Palmer). 24 Days should be one of the books read by Enron "junkies" because one book does not do justice to the entire complicated maze of the psychology, culture and business of Enron. A must read.

Great summary from the newswire's angle...

Published by Thriftbooks.com User , 20 years ago

This book gives a very clear description of "who knew what, when," or "who told what, when." The authors convey the excitement of trying to develop contacts within Enron and Arthur Andersen, and how they had to protect their sources. They describe in detail how they broke the story, and how, in 24 days, Enron and Anderson both imploded. I remember reading the original Wall Street Journal articles and being amazed at how the reporters covered the company, even after the media feeding frenzy began three weeks into the implosion.I agree with other reviewers who say the accounting schemes needed to be explained better. Basically, one needs to know the relationship between a company's balance sheet and cash flow statement. With that, the reader can understand how Enron tried to off-load its liabilities (from the balance sheet) and used Special Purpose Entities (such as LJM, LJM2, and the Raptors, which Enron funded) to inflate their income. The Special Purpose Entities themselves "paid" for the Enron assets with stock that Enron supplied to the Special Purpose Entities (without charging Balance sheet "Equity.") Get it? The house of cards was OK until Enron stock began falling.The story ends in 2003, and there have been a lot of developments since then. Nevertheless, this is an exciting story.

Great for those who didn't know much about Enron

Published by Thriftbooks.com User , 20 years ago

As a busy law student, I heard the hub about the Enron and Andersen demise. But I never knew the big players or how things happened. This book gave me a great background on how things unraveled. I felt as though I had read the newspaper reports on Enron from beginning to end. The authors made this book a quick-read. Despite the complexity of the Enron transactions that lead to its downfall, the authors tried to make reading comprension easier for those unfamiliar with corporate dealings and the accounting/financial industry tactics used to further Amercian business. This is a great book that underscored the importance of caution in investing, and also highlights the side of corporate America that are unrevealed to the average investor. Wonderful especially for those who didn't keep up with the scandal when it was initially unfolding.

Same Scandal...Different Perspectives

Published by Thriftbooks.com User , 21 years ago

This book will be especially valuable to those who have a keen interest in "the amazing rise and scandalous fall of Enron." I also commend to their attention McLean and Elkind's The Smartest Guys in the Room. Whereas Smith and Emshwiller explored the same company as investigative reporters, McLean and Elkind seem (to me) to have approached their subject as corporate anthropologists. Both books reach many of the same (albeit somewhat tentative) conclusions as to what happened...and why. Two significant differences are that Smith and Emshwiller limit their attention primarily to a period in 2001 extending from October 16th (when Enron announced huge losses caused by two partnerships) to December 2nd (when Enron filed for Chapter 11 bankruptcy); McLean and Elkind cover a two-year period of the company's "amazing rise and scandalous fall." Also, McLean and Elkind devote far more attention to each of the "smartest guys"; Smith and Emshwiller seem less interested in them, except in terms of the impact of their mismanagement and corruption. Let's say there are two books about the collapse of the twin towers at the World Trade Center; one focuses on the human tragedies associated with it whereas a second book addresses design, construction, and structural issues. Obviously, both approaches are valid.In certain respects, this book reminds me of Carl Bernstein and Bob Woodward's All the President's Men. In both, the reader is provided with a rigorous and comprehensive examination of the process by which investigative journalists generate, evaluate, and pursue leads, then tell a "story" based on the material they have accumulated. Smith and Emshwiller are the focal points in this book. Their reader feels as if she or he accompanies them each step of the way (at least I did) as they methodically probe ever more deeply into Enron's immensely complicated corporate infrastructure. As already suggested, their focus is less on the personalities of the deal makers than on the deals they made; also on how and why they were able to conceal various illegalities and improprieties long before December 3rd, 2001, when Enron filed for Chapter 11 bankruptcy. For me, one of the most interesting subjects which Smith and Emshwiller discuss is Arthur Andersen's association with Enron to which they devote several chapters. Given the nature and extent of Enron's financial implosion, what role did its longtime auditor play? And what about other reputable firms such as Citigroup, JPMorgan Chase, and Merrill Lynch which were also centrally involved with Enron's senior managers as they methodically and relentlessly constructed what has since been called "a house of cards"? Smith and Emshwiller could not have possibly provided definitive answers to questions such as these when their book went to press. Perhaps those answers will not be fully revealed for years to come.I am grateful for the opportunity to learn what I did from this book. My personal preference, however, is for McLean

Terrific reporting on an important story

Published by Thriftbooks.com User , 21 years ago

This is a terrific book. It should be read by anyone who invests because it will give you a better understanding of not only the Enron case, but of the problem of corrupt executives playing fast and loose with their responsibilities to the investors who employ them. Remember, the investors own the company, not the executives. They are hired help who are supposed to look after the interests of those who have put up hard cash for stock in the corporation and who are taking the financial risk as residual claimants. (Of course, those taking risks include the employees who probably have retirement investments in the company). It is a lively read and provides a great deal of valuable information along with the intrigue and outrageous revelations.There are three story lines that flow like counterpoint. I found them riveting, but I enjoy reading about business. (You probably do as well, or why are you reading about this book?)First, we follow Rebecca Smith and John Emshwiller as they track down leads in developing news stories about the sudden resignation of Enron's young CEO, Jeff Skilling. This seemingly minor story develops into the amazing and unexpected collapse of Enron as its corrupt financial dealings and improper accounting practices are exposed. We also follow the race between the authors as reporters for the Wall Street Journal racing against the New York Times, the LA Times, and the national TV news programs to get the story out first.Second, we get the story of Enron and how Ken Lay, Jeff Skilling, and especially Andy Fastow worked hard to keep the true state of the company hidden from investors and regulators. We see how they drew others into their plans and punished those who wouldn't go along. The story makes clear how Andersen was brought down by an account team that allowed their lust for tens of millions of dollars in consulting fees to corrupt their accounting responsibilities.Third, we see how both the climb and collapse of Enron affected average and honest people just trying to do their jobs. It was easy to get caught up in the rise of Enron and to believe in what was going on because the sickeningly corrupt practices were kept hidden for so long. Some of these executives, who reaped untold millions in personal rewards, might argue that everything was disclosed as required by letter of the regulations. But it seems to me that it was all just a way of lying while going to the right up to the edge of violating the letter of the law and then slipping over. Enron and Andersen management ended up not being as slick as they thought and ended up destroying both companies and hurting tens of thousands of innocent folks.Another virtue of this books is that it is straight reporting. Rather than being advocacy journalism, it reports the facts of the case as they unfolded. I like this approach a great deal and think it strengthens the message of the book. You are free to make your own interpretation of the events presented. The